How innovation shaped direct selling’s past, drives its present & defines its future

Listen to Part 1 of this story on this episode of The DSN Podcast. Even when your day is packed, we make it easy to stay informed, engaged and one step ahead.

Listen to Part 2 of this story on this episode of The DSN Podcast. Listen now or read below!

Innovation has been the heartbeat of direct selling for more than 150 years. It is what transformed a door-to-door book business into a $200 billion global industry that now spans wellness, beauty, home, energy, real estate, financial services and travel. And it is what must carry us forward again.

We find ourselves at an inflection point. Economic pressures are squeezing margins, and many leaders are weighing how best to navigate converging challenges while positioning for growth. The lesson from our own history is clear: this channel has never survived by playing defense. It has thrived when leaders dared to innovate—investing in research, ideas and models that were different, defensible and built for the future.

The purpose of this reflection is not to rehash old stories. It is to remind us that every era of growth in our industry was born from innovation—and to challenge today’s leaders to make the same choice.

The Legacy: Innovators Who Built the Channel

From its earliest years, direct selling has been fueled by pioneers who redefined what commerce could look like. Their stories remind us that innovation has never been optional—it has always been the differentiator.

James Robinson Graves | Southwestern | 1855

A Baptist minister and publisher, James Robinson Graves founded what became Southwestern with a mission to put books and Bibles directly into people’s hands. He organized students and independent sellers to earn their way through school by going door-to-door, teaching them scripts, territory management, financial discipline and the rhythms of seasonal selling. What began as a publishing venture evolved into a training ground for entrepreneurship.

Over time, Southwestern became synonymous with personal growth through enterprise. Generations of students credit the experience with building confidence, grit and communication skills that shaped their future careers. The company’s culture emphasized accountability, mentorship and character development—turning each summer’s sales program into a rite of passage.

Today, Southwestern Advantage continues that legacy as part of the broader Southwestern Family of Companies, helping students across the globe build business skills, resilience and financial independence.

Breaking new ground: Southwestern transformed selling into a vehicle for character and confidence, proving that commerce could cultivate human potential. By embedding mentorship and purpose into every transaction, it set the precedent for relationship-driven selling.

Carl & Adolf Vorwerk | Vorwerk | 1883

Founded in Wuppertal, Germany, Vorwerk began as a carpet and textile manufacturer before transforming into one of the most enduring direct selling enterprises in the world. In 1929, it introduced the Kobold vacuum cleaner, pioneering a new category in home cleaning.

By 1961, Vorwerk had launched the VKM5 multifunction kitchen mixer, and in 1971 it unveiled the first true Thermomix, an all-in-one appliance that combined mixing and heating functions, earning it a spot on the countertops of millions of kitchens worldwide.

Over time, Thermomix became a global phenomenon, pairing technology, training and community into a kitchen revolution, while Kobold remained a trusted pillar of home care. The company also founded akf bank in 1968. Today, it counts among Germany’s largest leasing and financing companies.

Vorwerk’s reach spans more than 60 countries, anchored by Thermomix and Kobold and in 2024 reported revenues of approximately $4.1 billion, coming in at #5 on DSN’s Global 100 List.

Breaking new ground: Vorwerk proved that even in durable goods, direct selling could thrive by making high-performing appliances personal, experiential and community-driven.

David H. McConnell | Avon | 1886

Avon began when book salesman David H. McConnell noticed his perfume samples were more popular than the books. In 1886, he pivoted to launch the California Perfume Company—later renamed Avon—and built it on a radical idea: empowering women as selling partners at a time when few professional opportunities existed for them.

The company’s “Avon Ladies” became cultural icons, carrying products door-to-door, building trust through relationships and service. This model gave women dignity, independence and income long before they had the right to vote or widespread access to the workforce. Avon’s system of recognition, incentives and community transformed selling into a source of pride.

Over the decades, Avon expanded globally, reaching more than 100 countries and recruiting tens of millions of representatives. At its peak, the company generated over $10 billion in annual revenue, making it one of the largest beauty brands in the world.

Breaking new ground: Avon normalized flexible entrepreneurship for women decades before the broader workforce caught up. By linking beauty with opportunity, it proved that direct selling could deliver both products and pathways to independence.

Alfred C. Fuller | Fuller Brush | 1906

Alfred C. Fuller started Fuller Brush in Hartford, Connecticut in 1906 from a basement workshop, selling brushes door-to-door. From early on, the innovation wasn’t just the product—it was the direct connection between the Fuller Brush Man and households, delivering quality tools with personal service and turning the ritual of home cleaning into a meaningful direct selling experience.

Fuller built trust by requiring agents to sign a pledge: “I will be courteous; I will be kind; I will be sincere; I will be helpful.” Over the decades, Fuller diversified its offering beyond brushes and brooms to include household cleaners, cosmetics (via its Débutante line) and personal care, while adapting its sales model.

Fuller Brush was among the first to introduce female agents (“Fullerettes”) to its field in the 1940s and later evolved toward modern direct selling and distributor models in the late 20th century.

Breaking new ground: By embedding service, trust and personalization into every customer visit, Fuller Brush demonstrated that direct selling’s power lies not just in what you sell, but how you deliver.

Jim Kirby | Kirby | 1920

Inventor Jim Kirby refined early vacuum designs, and by 1920 he had formalized distribution of his home cleaning machines through direct selling. Kirby’s approach combined durable, upgradeable systems with in-home demonstrations to showcase versatility—and over time, the vacuum evolved to encompass multiple attachments for shampooing, polishing and more. The product’s adaptability and longevity made Kirby more than a tool—it became a symbol of enduring household quality and pride.

By the mid-20th century, owning a Kirby was a statement—consumers invested once and expected longevity and attentive service in return. Today, Kirby continues operations under Right Lane Industries (which acquired it from Berkshire Hathaway in 2021).

The company still sells via independent distributors and in-home demonstrations, sustaining its model even as consumer purchasing trends evolve. Kirby proved that even high-ticket, durable items can become status symbols for customers.

Breaking new ground: By making cleaning a demonstrable experience rather than a transaction, Kirby anchored its brand in credibility—and showed that value in product performance and demonstration could reinforce one another.

Frank Stanley Beveridge & Catherine O’Brien | Stanley Home Products | 1931

Frank Stanley Beveridge founded Stanley Home Products in 1931 in Westfield, Massachusetts, adopting direct selling in 1938. What set Stanley apart was its introduction of the “hostess party plan”—a fresh alternative to door-to-door sales that brought people together for product demonstrations in a social setting.

Stanley’s product lines spanned more than 220 home care and personal care SKUs—laundry, floor care, fragrance, cleaning tools—designed to be demonstrated and explained in the home.

Along the way, its party format helped shape the careers of direct selling visionaries like Brownie Wise, Mary Kay Ash and Mary Crowley, who went on to adapt and scale the approach for their own companies. Catherine O’Brien’s leadership signaled early on that women could be not just participants but pioneers in shaping the industry’s direction.

Breaking new ground: Stanley Home Products showed that the real innovation wasn’t just in the products, but how they were shared. By transforming sales into a social event, it proved that direct selling could be built on connection and community as much as on the merchandise itself.

J.O. Riegal | Regal Ware | 1945

Founded in 1945 by J.O. Riegal, Regal Ware began as a Midwestern cookware manufacturer with a simple promise: making durable, high-quality stainless steel accessible to families. Rather than focusing solely on its own retail brand, Regal Ware became an umbrella manufacturer for much of the direct selling channel, producing private-label and co-branded cookware for a wide range of companies.

Its strength was quiet innovation—multi-ply metal construction, precision lids and consistent quality that direct selling companies could confidently demonstrate in homes around the world. As party-plan and in-home demo models grew, Regal Ware supplied the tools that made those experiences work, from everyday pots and pans to specialized waterless systems.

The 1979 acquisition of Saladmaster further cemented Regal Ware’s role at the intersection of manufacturing and direct selling, marrying production expertise with an education-driven field organization.

Breaking new ground: Regal Ware proved that behind-the-scenes manufacturing partners can be powerful innovators, enabling multiple direct selling brands to scale with reliable, demonstrable products that stand up to everyday use—and to the spotlight of the kitchen table.

Harry Lemmons | Saladmaster | 1946

Founded in 1946 by Harry Lemmons, Saladmaster introduced waterless cookware—a stainless-steel system that allowed food to be prepared with little or no added water, preserving nutrients and flavor. In the postwar era, when processed foods were on the rise, Saladmaster’s message of “better cooking for better living” stood out.

The company built its growth on in-home cooking demonstrations, where advisors prepared full meals to showcase both the cookware’s performance and a healthier way of eating. Kitchens became classrooms as hosts learned about low-moisture cooking, vegetable retention and portion balance. That experiential approach created community as well as sales, with recipes, classes and word-of-mouth extending the brand far beyond the party.

In 1979, Saladmaster was acquired by Regal Ware, gaining additional manufacturing strength and global reach while keeping its education-first mission intact.

Breaking new ground: Saladmaster proved that cookware could be more than a commodity—it could be a platform for teaching healthier lifestyles. By pairing innovation in product design with education-first demonstrations, it positioned direct selling as a driver of both better meals and better living.

Earl Tupper & Brownie Wise | Tupperware | 1946

Earl Tupper patented his airtight “burp” seal in 1946, solving everyday food storage problems with a design that created an entirely new product category. But it was Brownie Wise, beginning in 1951, who unlocked the market by pioneering the party-plan demonstration.

In living rooms across America, hosts showcased how the seal worked; turned customers into consultants; and transformed buying into a social event. Wise’s leadership also broke barriers—she became the first woman to appear on the cover of Business Week in 1954, a milestone in business history.

From the 1950s onward, Tupperware scaled into a global powerhouse, reaching more than 100 countries and becoming one of the most recognized household brands in the world. Millions of families owned its brightly colored bowls and containers, while its parties became cultural shorthand for social commerce.

Breaking new ground: Wise institutionalized recognition, training and culture—travel, rallies, trophies—so the salesforce felt seen and celebrated. This formula became a template for countless companies. Product innovation created a category. Go-to-market innovation created a movement.

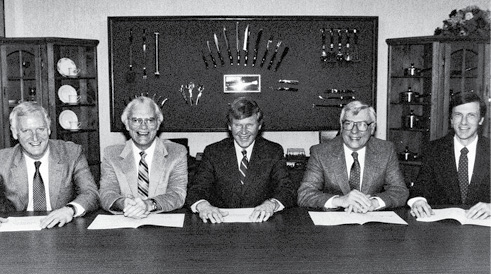

Alcoa & Case Cutlery (later Cutco Corporation) | 1949

Founded in Olean, New York, in 1949, Cutco entered the market with a promise that became its hallmark: a Forever Guarantee on every knife. This durability pledge distinguished the brand in an era of disposable goods, turning its cutlery into family heirlooms passed from one generation to the next and creating treasured traditions and memories built around kitchen tables.

Another clear differentiator was the company’s student sales force. By recruiting and training college students to demonstrate knives in homes, Cutco not only created a consistent channel for growth but also gave hundreds of thousands of young people a first experience in sales, entrepreneurship and personal development. By standing behind its products forever and mobilizing students as a force for growth, Cutco built both resilience and reach into its DNA.

Today, Cutco has sold more than 100 million knives and continues to be the largest manufacturer of kitchen cutlery in North America.

Breaking new ground: Cutco proved that even in a mature, commoditized category like kitchen knives, innovation in guarantee and go-to-market model could create staying power.

Dr. Forrest C. Shaklee | Shaklee | 1956

A wellness visionary, Dr. Forrest Shaklee introduced one of the first multivitamin formulations and insisted that products be grounded in nature and validated by science. Decades before “clean” and “green” became mainstream, Shaklee advanced the idea that everyday nutrition and non-toxic household products could greatly improve lives and profoundly protect the planet. His fusion of scientific credibility and environmental mindfulness positioned the company as a forerunner of the modern wellness movement.

Equally innovative was the company’s education-first selling culture. Consultants didn’t just sell—they taught, sampled and followed up, turning product knowledge into loyalty and long-term consumption. This emphasis on education built deep trust and steady reorder behavior, setting an early standard for customer retention through service and transparency.

Today, Shaklee holds the distinction of being a Certified B Corporation, reflecting its enduring commitment to sustainability, accountability and purpose-driven business.

Breaking new ground: Shaklee shifted the channel from one-time purchases to recurring, wellness-based consumption—and pioneered environmental stewardship as a business differentiator, proving that doing good and doing well could coexist.

Mary Crowley | Home Interiors & Gifts | 1957

Mary Crowley founded Home Interiors & Gifts with a simple but transformative vision: to empower women through the sale of home décor in a party-plan setting that turned social connection into economic opportunity. Her model centered on affordable, stylish décor—art prints, candles, floral arrangements and accessories—that made beautiful homes accessible to the middle class.

Crowley’s genius wasn’t just in product selection but in creating an environment where women could thrive professionally and personally. She placed faith, family and recognition at the heart of the business, fostering a culture of encouragement and belonging.

At its peak, Home Interiors became a cultural phenomenon, with tens of thousands of consultants across North America and billions in cumulative sales. Crowley’s leadership blended business acumen with heartfelt mentorship, proving that success could be both profitable and purposeful.

Breaking new ground: Crowley extended the party-plan model into lifestyle and home décor. By combining accessible products with a mission-driven culture, Home Interiors became one of the largest direct selling companies of its kind, giving countless women both financial opportunity and personal growth.

Rich DeVos & Jay Van Andel | Amway | 1959

After cutting their teeth distributing Nutrilite supplements, RICH DeVos and JAY Van Andel launched Amway in 1959 with a simple product (LOC cleaner) and a sophisticated idea: scalable support. They formalized training, leadership development and a compensation structure that rewarded both personal production and team development, turning independent sellers into business owners.

In 1972, Amway acquired Nutrilite, bringing into the fold one of the earliest multivitamin supplement brands and reinforcing wellness as its foundation. Amway’s global extended portfolio also includes brands like Artistry, eSpring and XS. Amway is truly a household name, standing for integrity, hard work and philanthropy around the globe. Amway is #1 on the DSN Global 100 List with $7.4 billion in revenue in 2024.

DeVos and Van Andel carried the banner of free enterprise worldwide, advocating for the value of direct selling and shaping the channel’s global reputation, a legacy that still resonates today.

Breaking new ground: Amway’s genius was systems—not just SKUs. Its global expansion, vertical integration and the strategic Nutrilite acquisition created permanence in wellness and home care.

Mary Kay Ash | Mary Kay | 1963

Mary Kay Ash took the spark ignited by Stanley, Avon and Home Interiors and built an empire rooted in purpose, recognition and possibility around it. Frustrated by the lack of entrepreneurial opportunities for women, she launched Mary Kay with a vision: to elevate women to be the driving force of the business. She reframed sales as service and recognition as rocket fuel.

Empowering women through personal development, coaching, celebrating and promoting became the central strategy for the company. The iconic pink Cadillacs became symbols of independence and achievement, while consultant education and party-plan demonstrations made beauty personal, social and repeatable.

Her “Golden Rule” philosophy—treating others as you wish to be treated—shaped a culture that blended empathy with excellence, setting new standards for recognition, mentorship and leadership. Today, Mary Kay products are sold in more than 40 markets internationally.

Breaking new ground: Mary Kay placed women firmly at the center of the business. By elevating their roles as entrepreneurs, leaders and achievers, she proved that culture and community could be competitive advantages.

Courtesy of Mary Kay Inc.

Luiz Seabra | Natura, B3: NATU3 (Brazil) | 1969

In Brazil, Luiz Seabra and co-founders fused high-performing beauty with purpose long before Environmental, Social and Governance (ESG) was coined. Natura elevated botanicals and biodiversity from the Amazon, investing heavily in scientific R&D and building sustainable sourcing partnerships that respected both communities and ecosystems. The company pioneered the use of natural ingredients within rigorous scientific frameworks, transforming regional flora into globally admired formulations.

Natura also professionalized the consultant experience—combining beauty education, environmental awareness and brand storytelling rooted in ethos as much as efficacy. Today, Natura operates in more than 100 countries, reaching millions of customers and consultants worldwide.

A certified B Corporation since 2014, Natura is the parent company of Avon’s Latin American business, including operations in Brazil, Mexico, Colombia, Chile, Peru and other markets. This footprint makes Natura one of the world’s most impactful beauty brands. The company ranks #4 on the DSN Global 100 List with 2024 revenue of $4.2 billion.

Breaking new ground: Natura taught the channel that values can be a scalable asset—and that you can build global brands by aligning product innovation with environmental and social stewardship.

Gene & Kristine Hughes | Nature’s Sunshine, NASDAQ: NATR | 1972

What began with one couple encapsulating cayenne pepper at their kitchen table evolved into a company that helped define modern herbal supplementation. Nature’s Sunshine brought scientific rigor to natural health, pioneering encapsulation, ingredient transparency and in-house manufacturing in an era when “herbal” still meant fringe.

Decades before wellness became mainstream, the Hughes family positioned the brand around education and empowerment, teaching distributors to understand both product and purpose. They built a culture rooted in trust, authenticity and science-backed communication—ensuring that every consultant could confidently explain not just what to take, but why it worked. This mindset turned early skepticism into loyalty, laying the foundation for an enduring global presence.

Today, Nature’s Sunshine remains a pioneer in clean-label manufacturing and sustainable sourcing, serving customers in more than 40 countries. They are #25 on the DSN Global 100 List with revenue of $454 million in 2024.

Breaking new ground: Nature’s Sunshine proved that natural wellness could be both credible and scalable. It gave legitimacy to a category—and a profession—that would reshape the supplement industry.

Rex Maughan | Forever Living | 1978

Rex Maughan saw potential in aloe vera decades before it became a wellness mainstay. In 1978, he founded Forever Living around the belief that nature’s most versatile plant could serve as the cornerstone of a global wellness brand. The company pioneered aloe-based nutrition, skincare and personal care, creating formulations that introduced the ingredient to consumers long before “plant-based” became a marketing trend.

What made Forever Living truly distinctive was its vertical integration model. Maughan built a proprietary supply chain system that spanned aloe plantations, processing facilities and manufacturing operations, ensuring control over quality, consistency and sustainability at every stage. This approach not only safeguarded the plant’s purity but also demonstrated how ownership of the full production cycle could become a long-term competitive advantage.

Today, Forever Living operates in over 140 countries with millions of distributors and customers worldwide, continuing to expand the reach of aloe-based wellness.

Breaking new ground: Forever Living didn’t just sell aloe vera—it brought aloe to the mainstream, proving that one powerful natural ingredient—combined with proprietary supply chain control—could anchor a global wellness brand.

Petter Mørck | Arbonne | 1980

Founded in Switzerland and launched in the United States in 1980, Arbonne brought European botanical principles to modern wellness long before “clean” and “plant-based” became popular. At the heart of its formulations was aloe vera, used as a core ingredient for hydration, soothing and nourishment across skincare, nutrition and personal care. Petter Mørck envisioned a company where beauty, health and wellness were inseparable—and where ingredient integrity defined success.

Over four decades later, Arbonne continues to blend plant-based innovation with ethical business practices, maintaining vegan formulations and rigorous sustainability standards. Its community of independent consultants shares more than products—they share a holistic approach to well-being rooted in balance, mindfulness and environmental stewardship.

In January 2026, Arbonne will open its new global headquarters, a milestone that reflects its continued growth and investment in people, purpose and planet. Recognized as a Certified B Corporation, Arbonne remains a model for transparent, sustainable entrepreneurship.

Breaking new ground: Arbonne proved that performance and purity can coexist, setting the standard for the modern, botanically powered wellness company.

Mark Hughes | Herbalife, NYSE: HLF | 1980

When Mark Hughes launched Herbalife in 1980, he envisioned nutrition made simple, social and accessible for everyday consumers. He built the company around repeatable programs anchored in coaching, community and visible results. Hughes championed the idea of daily consumption and persistent follow-up, reinforced by rallies and recognition events that made healthy living a movement rather than a product pitch.

Equally central to Herbalife’s rise was its emphasis on personal development. Hughes invited motivational leader Jim Rohn to train and inspire distributors, infusing the organization with a culture of mindset, mentorship and belief in human potential. That focus became a defining hallmark of Herbalife’s identity.

Today, Herbalife operates in 94 countries, serving millions of customers and independent distributors. It ranks #2 on the DSN Global 100 List with 2024 revenue of $5 billion, underscoring its enduring scale and global relevance.

Breaking new ground: Herbalife made wellness both social and measurable, while later innovations like nutrition clubs translated the model into community hubs. More importantly, Herbalife streamlined the sharing process into easy, actionable steps any distributor could quickly embrace and master.

Doris Christopher | Pampered Chef NYSE: BRK.A / BRK.B | 1980

When Doris Christopher founded Pampered Chef in 1980, she reimagined how people discovered kitchenware. Her “kitchen show” concept turned product demonstrations into shared experiences—where guests could see tools in action, taste recipes and learn new cooking skills in a relaxed, social setting. Consultants became culinary coaches, transforming household demonstrations into moments of confidence, connection and empowerment rather than solely sales opportunities.

This approach democratized home cooking and bridged the gap between education and sales. Over the decades, Pampered Chef refined the model, introducing innovative cookware and practical time-saving tools designed for real families. As technology reshaped behavior, the company transitioned seamlessly to digital platforms—hosting virtual kitchen shows, interactive recipes and online communities that preserved its personal touch in a modern format.

In 2002, its acquisition by Berkshire Hathaway gave Pampered Chef the long-term backing to sustain innovation while maintaining its values-based culture and consultant-first ethos.

Breaking new ground: Pampered Chef pioneered experiential, education-driven selling in the home and reimagined it digitally decades later—demonstrating that consumer engagement is the ultimate ingredient.

Graeme Clegg | New Image International | 1984

Aspiring entrepreneur and sheep farmer Graeme Clegg founded New Image International in 1984 with a vision to harness colostrum—nature’s first food—for immune health. Long before the ingredient gained scientific attention, he saw its potential as a nutrient-dense natural resource and built a wellness enterprise around its benefits.

With the launch of the Alpha Lipid line, New Image became one of the first companies to bring colostrum-based nutrition to market at scale, establishing both a viable category and a loyal following across the Asia-Pacific region. The company coupled innovation with scientific validation and distributor education, enabling representatives to confidently present products with credibility and authority.

Today, New Image operates in more than 20 countries around the world and ranks #38 on the DSN Global 100 List, reporting 2024 revenue of $261 million.

Breaking new ground: By pioneering colostrum and elevating immune health, New Image not only created a new product category but also demonstrated how a science-backed, ingredient-first strategy could drive both credibility and long-term resilience in the wellness space.

Blake Roney, Sandie Tillotson & Steve Lund | Nu Skin, NYSE: NUS | 1984

Nu Skin launched with a focus on premium, science-backed personal care and later expanded into nutrition and wellness globally. Its biggest differentiator, however, has been its implementation of devices—beauty and wellness tools like the ageLOC LumiSpa iO that pair consumables with hardware to deepen engagement while garnering awards and recognition around the world.

Nu Skin’s commitment to innovation has paid off: it has been ranked the world’s number one beauty device systems brand for multiple consecutive years by Euromonitor and has received recognition for innovation from the Edison Awards and others. A billion-dollar company, Nu Skin is #11 on the DSN Global 100 List with revenue of $1.7 billion in 2024.

By earning external industry accolades for its beauty technology, the company showed that innovation in format (devices plus consumables) can elevate brand credibility; create defendable differentiation; and rewrite what a wellness company can be.

Breaking new ground: Nu Skin proved that direct selling could successfully integrate devices into its model—and not just compete, but thrive, and ultimately—lead.

Frank VanderSloot | Melaleuca | 1985

When Frank VanderSloot founded Melaleuca in 1985, he helped introduce tea tree oil to the global market, transforming a niche botanical into a cornerstone of natural wellness. Building on that foundation, the company expanded into nutrition, personal care and eco-friendly household products, all centered on the idea that everyday items could support healthier lifestyles.

VanderSloot combined this ingredient-led innovation with a value-driven pricing model, emphasizing fairness, accessibility and loyalty. Rather than relying on high-pressure sales, Melaleuca developed a membership shopping club that rewarded repeat purchases and customer retention—an approach that predated modern subscription and auto-ship trends.

Equally distinct was its financially conservative culture. VanderSloot promoted debt-free business practices and personally attended mortgage burnings for top distributors, reinforcing Melaleuca’s belief in financial independence as a measure of success. Today, Melaleuca operates in more than 20 countries.

Breaking new ground: Melaleuca’s innovations combined ingredient leadership with customer-centric pricing and a values-based culture. By aligning affordability, loyalty programs and financial prudence, it created one of the most durable product-driven growth models in the channel.

Jorge Vergara | OMNILIFE | 1991

Jorge Vergara launched Omnitrition de México in 1991 (later rebranded as OMNILIFE in 2000) with the vision of combining health products with life transformation. What set OMNILIFE apart was its “Multidesarrollo” or multi-development philosophy: not just product consumption, but personal growth—financial, emotional and professional—as a core part of the opportunity.

From its early days distributing nutritional supplements, OMNILIFE built momentum across Latin America and beyond—growing its “aliados” (distributors) base into millions. In Mexico alone, it now employs thousands. It also operates major manufacturing plants in Mexico and Colombia with a US plant opening soon. OMNILIFE is in 20 countries and offers more than 300 products in nutrition and personal care. It is #20 on the DSN Global 100 List with $584 million in revenue.

By pairing wellness products with opportunities for growth, belonging and recognition, OMNILIFE transformed direct selling into a movement rooted in a philosophy of holistic well-being and human connection.

Breaking new ground: OMNILIFE embedded personal development into its business model, aligning with the strong cultural values of community and family that define much of Hispanic and Latino life.

Rolf Sorg | PM-International | 1993

PM-International, founded by Rolf Sorg, remains one of the largest direct selling companies in health and wellness, with 33 consecutive years of growth and over $3 billion in revenue across 45 markets. The company currently sits at #6 on the DSN Global 100 List and has won the Bravo International Growth Award five years running.

Its flagship FitLine nutrition series was built on cutting-edge research in cellular nutrition and bio-availability. Quality products are at the core of PM-International’s success—they are poised to go over one billion products sold soon. What sets PM-International apart is its discipline of continuous product refinement: formulas are deliberately rotated and constantly improved, ensuring the story is never static.

The company is expanding into the Americas in a big way, with a new headquarters for the region in Sarasota, Florida that opened in November 2025.

Breaking new ground: By institutionalizing reinvestment and innovation, PM-International created a model that keeps its products fresh; its field energized; and its growth consistent—an uncommon feat in a channel where many products remain unchanged for decades.

Bjørn Nicolaisen & Debbie Bolton | Norwex | 1994

Norwex began in Norway when attorney Bjørn Nicolaisen discovered the potential of an advanced microfiber cloth that cleaned with only water—eliminating the need for harsh chemicals and reducing environmental waste. What started as a practical innovation quickly evolved into a mission-driven brand built around the idea of creating a safer, cleaner home.

In the late 1990s, Debbie Bolton introduced Norwex to North America, where she helped shape the company’s consultant culture and long-term growth strategy. Her focus on recognition, education and community created a field environment grounded in purpose and empowerment. Together, Nicolaisen’s innovation and Bolton’s leadership bridged science, sustainability and social selling.

Over time, Norwex expanded beyond cleaning cloths into personal care and eco-friendly home products, aligning with consumer demand for greener, chemical-free living. Today, the company operates in more than 20 countries, supporting tens of thousands of consultants and millions of customers worldwide.

Breaking new ground: By pairing Nicolaisen’s product innovation with Bolton’s cultural leadership in North America, the company transformed a microfiber cloth into a global movement for healthier homes.

D. Gary Young & Mary Young | Young Living | 1994

Young Living mainstreamed essential oils with a simple but powerful promise—purity and provenance—supported by its vertically integrated “Seed to Seal” process. From seed planting to distillation and final bottling, D. GARY AND MARY YOUNG gained a deep understanding of their supply chain, ensuring authenticity and traceability in a category often lacking both. This commitment built deep consumer trust in product integrity and established a new benchmark for transparency.

Education was equally critical. Young Living’s distributors taught the benefits of essential oils through workshops and community classes, transforming aromatherapy from a niche practice into a global wellness movement.

Now, with the launch of Wyld Notes, Young Living is reimagining how its next generation of customers connects to wellness. The new brand introduces an affiliate model—bridging community and creator economies to reach younger audiences through digital storytelling, scent and lifestyle. It marks a bold evolution for a legacy brand rooted in authenticity.

Breaking new ground: The innovation was equal parts supply chain and story. By mastering the process end-to-end and equipping customers with knowledge, Young Living turned essential oils into a global wellness movement.

Dr. Gustavo Bounous & Dr. Patricia Kongshavn | Immunotec | 1996

Medical researchers Gustavo Bounous and Patricia Kongshavn founded Immunotec to bring decades of advanced glutathione research to consumers. From the outset, the company centered its mission on a single science-backed innovation—Immunocal—which has remained the foundation of the brand for nearly 30 years.

Immunotec’s rare discipline and focus established credibility through global patents, clinical validation and long-term consistency. Rather than chasing trends, the company expanded deliberately, introducing targeted formulations that built upon its core science in immune health.

In 2017, CEO Mauricio Domenzain, acquired Immunotec and took it private—unlocking an accelerated growth phase marked by substantial investment in manufacturing, technology and infrastructure. Since then, the company has expanded its footprint across Europe, Latin America and the United States.

By remaining anchored in its scientific foundation while executing thoughtful product and geographic expansion, Immunotec has demonstrated how innovation rooted in discipline can deliver enduring credibility and sustained momentum.

Breaking new ground: Immunotec pioneered glutathione supplementation, then showed how steady product focus paired with bold ownership change could fuel reinvention.

Joni Rogers-Kante | SeneGence | 1999

Joni Rogers-Kante built a thriving business with Mary Kay, rising through the ranks and learning first-hand how recognition, community and perseverance could transform lives. That experience gave her both the confidence and the conviction to launch her own company, SeneGence. In 1999, she introduced LipSense, a long-wearing, smudge-resistant liquid lip color that struck a chord with consumers and consultants alike.

From that single innovation, SeneGence expanded into a global cosmetics and skincare enterprise. Yet LipSense remains its cornerstone—having generated more than $2 billion in cumulative revenue and defining a category of durable, high-performance beauty.

Beyond its products, SeneGence is known for its supportive culture and philanthropy, with Rogers-Kante championing initiatives that empower women, fund education and advance community well-being. Her leadership style—grounded in gratitude, mentorship and service—has helped foster a company that values both personal success and collective purpose.

Breaking new ground: SeneGence proved that a hero beauty product—backed by a founder who combined direct selling success with a values-driven approach—could validate an entire business model.

David Schmidt | LifeWave | 2004

LifeWave demonstrates how sustained R&D and defensible IP can create breakout growth. Its hero product, the X39 phototherapy patch, is made to reflect body-emitted light and support healthy energy and physical performance without stimulants. This innovative wearable has helped power the company’s trajectory.

LifeWave is also pushing into hydration with X2O: Light-Infused Water, a cutting-edge system combining dual-stage filtration, hydrogen enrichment and patented light infusion. X2O is designed to amplify the effects of LifeWave’s patch technology, integrating into daily wellness routines in a way that stretches across multiple categories.

Between 2018 and 2024, revenue jumped from less than $20 million to $555 million (#22 on the DSN Global 100), representing roughly 3,000 percent growth. With more than 200 global patents, the company has built a deeply defensible product portfolio and won a DSN Bravo Innovation Award.

LifeWave and its founder DAVID SCHMIDT champions innovation not only in what it sells—it’s innovating in how it builds.

Breaking new ground: LifeWave’s culture around multiple patches, synergistic products and even cross-collaboration with related ventures like Thunderstrike—a humanitarian drone project designed to deliver aid to disaster zones—reflects a team pushing boundaries.

Orville & Heidi Thompson | Scentsy | 2004

Orville & Heidi Thompson launched Scentsy with a singular focus on wickless wax and warmers, pairing fragrance innovation with a people-first culture, standing out for its authentic scent experiences and warm, personal consultant interactions.

A landmark step was Scentsy’s multi-year relationship with Disney via licensed warmers, wax bars and Scentsy Buddies that brought beloved characters into homes. These co-branded collections demonstrated how storytelling and nostalgia could deepen loyalty and keep the catalog feeling fresh season after season.

In 2025, Scentsy took another bold step with the launch of Scentsy Candles. Once known only for flame-free fragrance, the company is now expanding to “own the fragrance ritual” across warmers, diffusers, fan systems and candles.

Today, it operates in more than 10 countries with over 200,000 independent consultants and sits at #24 on the DSN Global 100 List with $472 million in annual revenue.

Breaking new ground: Scentsy proved that authenticity itself can be an innovation. By layering licensed collections and moving into mainstream candles, it showed how a direct selling brand can evolve while staying true to its soul.

Ørjan & Hilde Sæle | Zinzino, NASDAQ First North: ZZ B (Sweden) | 2005

Zinzino positioned itself as a pioneer of test-based nutrition, making personalization its defining innovation. Its flagship BalanceTest (a dried blood spot test that measures omega-6/omega-3 ratios) and companion BalanceOil blend embodied its philosophy: “test, don’t guess.” Over time, the company expanded its testing portfolio to include gut health, vitamin D and HbA1c, deepening its credibility as a science-first wellness brand.

Zinzino has also leaned into bold expansion, weaving their distributors and product lines into its test-driven ecosystem. In 2025, the company reported year-over-year growth of over 50 percent, underscoring momentum behind its science-anchored approach. This approach has led to undeniable results—the company ranked #44 on the DSN Global 100 List with 2024 revenue of $200 million.

By combining precise diagnostics with tailored nutrition, Zinzino bridged the gap between science and everyday wellness, transforming supplementation from routine consumption into a data-driven health experience.

Breaking new ground: Zinzino reframed the role of direct selling in nutrition by embedding scientific testing and proof into the customer journey. Instead of just distributing supplements, it champions personalized health data—turning validation into the ultimate differentiator.

David Stirling, Gregory Cook, Emily Wright, Dr. David Hill, Corey Lindley & Rob Young | dōTERRA | 2008

Launched by a team of industry veterans, dōTERRA quickly became a global leader in essential oils by combining scientific rigor, ethical sourcing and community-based education. The company instituted Certified Pure Tested Grade (CPTG) standards to ensure potency and purity—settling a new benchmark for quality in an unregulated category.

Through its Cō-Impact Sourcing partnerships, dōTERRA built sustainable relationships with growers and distillers across more than 45 countries, improving livelihoods while strengthening supply chain transparency.

What further set dōTERRA apart was its people-centered model. Its independent distributors—known as Wellness Advocates—were trained not just to sell, but to educate, mentor and model holistic living. That blend of purpose and professionalism fueled rapid expansion.

In just over a decade, dōTERRA scaled to billions in annual sales and tens of millions of customers worldwide, ranking #10 on the DSN Global 100 List with 2024 revenue of $2 billion.

Breaking new ground: dōTERRA demonstrated that speed to market, ethical sourcing and education could turn emerging wellness trends into a durable global brand.

Brian Underwood | Prüvit | 2015

Brian Underwood and Prüvit entered the wellness space with a bold bet on exogenous ketones, particularly BHB (beta-hydroxybutyrate) formulas. By positioning itself as a leader in metabolic health and pioneering a new category, Prüvit generated billions in revenue in the past ten years. Its flagship KETO//OS line and derivative blends helped catalyze broader interest in “ketone supplementation” as a category rather than a niche trend.

In April 2025, Prüvit struck a landmark deal: Herbalife agreed to acquire Prüvit’s assets (alongside other related enterprises) in a move that brings ketone supplementation to one of direct selling’s giants. The structure allows Prüvit to continue operating independently, and the integration signals both companies’ belief that ketones may be a strategic growth vertical.

Beyond product innovation, Prüvit cultivated a passionate global community, blending science, lifestyle and personal transformation to turn ketone use into a movement, not just a market.

Breaking new ground: Prüvit’s rise popularized ketones as a mainstream wellness category, and its alliance with Herbalife underscores how a specialized innovation can attract acquisition interest—and validate a vertical as worthy of institutional backing.

Josh Anderson, Roger Ball, Zach Davis & Richard Hansen | 7k Metals | 2016

7k Metals has carved out a unique space in direct selling by blending network marketing with precious metals, collectible coins and modern membership models. The company sells graded coins, bullion and themed collectible pieces, many designed in house or in partnership with reputable mints. Members benefit from programs like AutoSaver (a recurring coin allocation), secure storage options, wallet tools and curated coin drops.

Leadership recently transitioned with Blake Davis, formerly Chief Sales & Marketing Officer, stepping into the CEO role in August 2025. Former CEO Jayson Arfmann shifted his focus and expertise to helping the company expand internationally, reflecting the company’s accelerating global ambitions and presence. 7k’s success has been phenomenal as they’ve introduced an unprecedented number of new customers to the power of precious metals through their innovative buying platform, where gold and silver can be purchased fractionally and stored securely.

Breaking new ground: By simplifying membership, designing distinctive coin lines and providing tools that make precious metals more accessible, 7k has modernized a traditionally niche and regulated category.

Armand Puyolt | Vida Divina | 2016

A lifelong wellness advocate and veteran of the channel, ARMAND PUYOLT launched Vida Divina in 2016. Puyolt’s own health journey inspired his belief in natural products and personal transformation, shaping a company rooted in wellness and empowerment. He started Vida Divina specifically to serve the Hispanic/Latino market, where the culture of community and family proved a natural fit for direct selling.

Vida Divina quickly gained traction with products like TeDivina detox tea, expanding into supplements, functional coffees and skincare. In recent years, the company has accelerated growth through strategic acquisitions, including Peruvian brand MIALÉ and US-based Radien—moves that broadened its distributor reach and added advanced skincare science to its portfolio to create a more comprehensive product assortment. Today, Vida Divina operates in more than 50 countries worldwide with hundreds of thousands of distributors.

Breaking new ground: Vida Divina showed that founder conviction, paired with strategic acquisitions, can create a differentiated path to scale—where personal belief and bold business moves fuel both credibility and growth.

Surging Services

If products have given us some of our most visible brands, services are quietly powering some of the industry’s strongest growth. In fact, services have been outperforming products as a category for a decade. The reasons are clear: digital platforms scale quickly; companies don’t have to compete with goliaths like Amazon and Wal-Mart; and subscriptions drive recurring revenue.

Harland Stonecipher | PPLSI (Pre-Paid Legal/LegalShield) | 1972

Harland Stonecipher turned an intimidating, high-cost category—legal services—into an affordable monthly membership that put professional help within reach of everyday families. His vision was to “productize peace of mind,” converting what was once a reactive, expensive process into a proactive service built on accessibility and trust.

By creating a nationwide network of attorneys and identity theft specialists, Stonecipher introduced recurring value, predictable revenue and long-term customer loyalty to a traditionally transactional industry.

More than fifty years later, PPLSI stands as a pioneer in subscription-based professional services. It has evolved into a diversified company offering LegalShield and IDShield, protecting millions of individuals and businesses across North America. Its steady, incremental growth has proven that even in highly regulated sectors, services can be simplified, scaled and personalized.

PPLSI ranks #21 on the DSN Global 100 List with 2024 revenue of $561 million.

Breaking new ground: PPLSI showed that services removing friction from daily life—like legal and identity protection—can become enduring, trust based memberships. Its innovation proved that subscriptions built on necessity, not luxury, could thrive for generations.

Art Williams | Primerica, NYSE: PRI | 1977

Art Williams pioneered the simple but powerful idea of “buy term and invest the difference,” making financial literacy and affordable protection accessible to middle-income families. He launched the business in 1977 as A.L. Williams & Associates, building it into one of the fastest-growing life insurance organizations in the country. In 1991, the company was renamed Primerica, marking its transition into a broader financial services powerhouse, ultimately going public in 2010.

Perhaps more importantly, he introduced the first tiered compensation model for financial services agents, creating a pathway that rewarded both production and leadership. This system became the forerunner of today’s $12 billion life insurance and broader financial services market in US direct selling. Primerica is #7 on the DSN Global 100 List with 2024 revenue of $3.07 billion.

Williams’s vision transformed countless families into first-time investors, proving that empowerment and education could drive both prosperity and purpose in financial services.

Breaking new ground: Williams proved that a clear mission, combined with pioneering compensation design and simple financial strategies, could reshape an entire category and seamlessly bring Wall Street concepts to Main Street.

Gary Keller | Keller Williams | 1983

When he founded Keller Williams in 1983, Gary Keller set out to build a company that put agents at the center of success. He pioneered a tiered profit-sharing model that allowed associates to share directly in their office’s financial performance, transforming the traditional brokerage into a collaborative platform for entrepreneurship and growth.

The model was paired with world-class training, mentorship and technology systems, enabling agents to grow sustainable businesses under a shared brand. Keller Williams also cultivated a distinctive culture of transparency and personal growth, reinforcing that collective success could outperform competition.

By the summer of 2024, Keller Williams had paid out over $2 billion in profit sharing to associates and expanded into more than 50 regions worldwide, becoming one of the largest real estate networks on the planet.

Breaking new ground: Keller Williams introduced a profit-sharing model that rewarded agents for contributing to office growth and performance. While not equity-based, this system created loyalty and drove rapid expansion by giving agents a financial stake in their local office’s success.

Kenny Troutt & Steven Smith | Excel Communications | 1988

KENNY Troutt and STEVEN Smith recognized a powerful opportunity in the newly deregulated long-distance phone market of the late 1980s. By applying a direct selling model to telecommunications, they enabled everyday representatives to build income through recurring billing—an approach that turned a commodity service into a scalable business.

Within just a few years, the company expanded nationwide, attracting millions of customers and developing one of the largest independent sales forces in the industry. In 1996, Excel achieved a remarkable milestone—it became the youngest company ever listed on the New York Stock Exchange (NYSE). Annual revenues climbed into the billions, and by the end of the decade, Excel had cemented its place as one of the defining success stories in service-based direct selling.

In November 1998, the company merged with Teleglobe Inc. in a $3.2 billion stock swap, marking one of the largest deals in the channel’s history.

Breaking new ground: Excel proved that “essential services” could be sold through person-to-person distribution with residual billing, setting a template many later service innovators would follow.

Greg Provenzano, Robert Stevanovski, Mike Cupisz & Tony Cupisz | ACN | 1993

Founded in 1993, ACN set out to be a reseller of long-distance telecommunications services through direct selling, allowing independent representatives to earn income by helping customers save money on essential services. Over time, the company expanded into cellular service, internet, energy and other recurring household utilities, transforming itself into one of the most diversified service-based direct selling enterprises in the world.

Innovation has long been part of ACN’s DNA. In the early 2000s, it introduced the IRIS video phone, an ambitious product that foreshadowed today’s video communication trends. While that innovation proved short-lived, it demonstrated the company’s willingness to explore new technologies and evolve with changing consumer behavior.

While the company now concentrates solely on US and Canadian markets, its commitment to core services has sustained its relevance for more than three decades. Its steady performance underscores how reliability and simplicity—anchored in essential, repeat-use services—can sustain trust.

Breaking new ground: ACN’s true impact was its ability to build a long-lasting business around essential recurring services—telephone, internet, mobile and energy—that customers needed month after month.

Charles Wigoder | Utility Warehouse, LSE: TEP (UK) | 1996

Utility Warehouse, the consumer-facing brand of Telecom Plus, disrupted the utilities market by uniting energy, broadband, mobile, landline and insurance under a single monthly bill. In an industry dominated by large corporations and complex tariffs, Utility Warehouse stood out for its clarity, value and trust-based approach. The company empowered everyday people to build income by recommending essential services they already used, turning customers into advocates.

That strategy proved transformative. Partners focused on saving customers money and simplifying their lives, while the bundled model rewarded loyalty. The result was a business that grew organically through word of mouth.

The company has 1.3 million customers and supplies millions of bundled services through the convenience of a single bill, demonstrating the enduring appeal of focus and simplicity. They generated $2.6 billion in annual sales during the fiscal year in just one country. Utility Warehouse is #9 on the DSN Global 100 List, with more than two times the revenue of all UK product companies combined.

Breaking new ground: Utility Warehouse showed that essential services could be transformed into a sticky, loyalty-driven membership model.

Jere Thompson, Jr. & Chris Chambless | Ambit Energy, NYSE: VST | 2006

Ambit scaled quickly by focusing on deregulated energy markets with straightforward value propositions, simple enrollment and a strong recognition culture. First-to-market programs like customer referral incentives (“free energy”) reinforced viral acquisition, retention and long-term loyalty.

Operating primarily in the United States, Ambit attracted hundreds of thousands of independent consultants and millions of customers, delivering essential services through a network model traditionally associated with wellness or consumer goods. That adaptability became its competitive edge.

The company consistently generated more than $1 billion in annual revenue at its peak and continues to hit that mark today, sitting at #14 on the DSN Global 100 List with 2024 revenue of $1.03 billion. Ambit is now part of Vistra Corp., a publicly-traded energy company, giving it additional scale and stability.

Breaking new ground: Ambit proved that when the product is an essential service, clarity and convenience are your best marketers. Its ability to build a billion-dollar business largely within just a handful of states underscores how powerful the right model can be in deregulated markets.

Glenn Sanford | eXp Realty, NASDAQ: EXPI | 2009

Glenn Sanford took the Keller Williams profit-sharing model and improved it—transforming profit sharing into revenue sharing and moving the brokerage entirely into the cloud. By eliminating brick-and-mortar offices, eXp radically reduced overhead while giving agents revenue share on transactions.

In 2013, Sanford went a step further, taking the company public and beginning to share equity with the field, accelerating eXp’s revenue dramatically. This model evolved real estate into one of the largest service categories in direct selling, today representing a $15 billion market in the US.

eXp became the model that others scrambled to copy. Today, eXp is recognized as a real estate giant in the US—and by some measures, the world—because of its unified, cloud-based model. Unlike franchise systems where agents affiliate with independent offices, every agent at eXp belongs to a single brokerage. It is #3 on the DSN Global 100 List with $4.6 billion in revenue in 2024.

Breaking new ground: By pairing cloud-based operations with both revenue sharing and stock ownership, Sanford created a faster and leaner brokerage and wealth-creation platform.

Amanda Tress | FASTer Way to Fat Loss | 2016

Fitness entrepreneur Amanda Tress founded FASTer Way to Fat Loss with the vision of combining digital coaching, intermittent fasting, carb cycling and whole-food nutrition into a scalable, technology-driven program.

What set the brand apart was its enhanced affiliate model, empowering health coaches, trainers and everyday advocates with digital tools to build thriving businesses while supporting client transformations. This approach blurred the line between influencer marketing and direct selling, showing how personal brand and purpose could fuel sustainable growth.

FASTer Way’s emphasis on holistic wellness and education has attracted a loyal following among both consumers and entrepreneurs. In 2023, FASTer Way was honored as the first recipient of the Bravo Innovator Award by Direct Selling News, recognizing its pioneering use of emerging technologies and future-focused strategy in the direct selling channel.

Breaking new ground: FASTer Way to Fat Loss showed that digital platforms and affiliate-style partnerships can deliver direct selling scale. By fusing fitness expertise with accessible coaching technology, Tress reframed what a wellness company could look like in the digital era.

Michael “Hutch” Hutchinson & Frank J. Codina | inGroup (formerly inCruises) | 2016

Founded in 2016, inGroup reimagined how people access cruise and travel experiences by pairing direct selling with a digital membership model. What began as a cruise travel club has evolved into a comprehensive lifestyle platform where members can book hotels, resorts and experiences worldwide through an exclusive subscription system.

By blending technology, travel and community, the company created a more accessible way for families and entrepreneurs to participate in a high-cost leisure category.

Approaching its tenth anniversary, inGroup continues to grow under the financial leadership of Anthony Varvaro, CFO/COO, who has emphasized fiscal discipline and global expansion. The company’s hybrid model of membership and referral rewards has helped it scale across dozens of markets while maintaining a premium brand image. In 2024, inGroup ranked #39 on the DSN Global 100 List with reported revenue of $253 million and exceeded $300 million in annual sales in 2025.

Breaking new ground: inGroup shows how technology can reinvent even established industries, creating exclusivity, scale and lifestyle appeal that competitors have struggled to match.

Companies to Watch

The legacy of innovation is not just history—it is a blueprint. Today, brands like Olive Tree People/Oliveda and The Super Patch Company are proving that the same principles of defensibility, differentiation and courage continue to drive success.

Thomas Lommel | Olive Tree People (Oliveda), OTC: OLVI | 2023

Thomas Lommel and Olive Tree People are rethinking beauty by eliminating the water most products depend on. Using hydroxytyrosol derived from olive leaf, their formulations replace up to 70 percent of the water and preservatives typically found in conventional cosmetics, delivering clean, waterless beauty aimed at results, sustainability and high impact. Their approach centers on a direct-to-consumer model through consultants who educate as much as they sell, creating both credibility and momentum.

The company experienced significant growth in the first half of 2025 compared to 2024 and is projecting at least $150 million in annual revenue in its third year. Tens of thousands of consultants, expanded warehousing and direct distribution in the US are fueling that trajectory, with further expansion into Canada and Europe underway.

Breaking new ground: Olive Tree People isn’t just innovating on ingredients—it’s building a movement. By combining a water-free product philosophy with educational selling, rapid global growth and eco-conscious initiatives—including funding water wells with proceeds from product sales—the brand is carving out a unique role in the future of clean beauty.

Jay Dhaliwal | The Super Patch Company | 2023

Super Patch, led by Jay Dhaliwal, is already making waves—and doing so in smart ways. Its technology is called Vibrotactile Trigger Technology (VTT). The idea is simple: patches with specially designed contour-ridge patterns that when applied to the skin stimulate neural responses to deliver benefits without chemicals, drugs or invasive procedures.

From its inception, Super Patch has invested heavily in research, testing and patents. That foundation has fueled rapid growth: at the end of 2025, the company reported $350 million in cumulative revenue. Its partner network has expanded quickly across Europe and North America, supported by a scalable digital platform and logistics infrastructure.

Dhaliwal’s background in tech/software operations also plays a role. He approaches product development by identifying gaps in what consumers want, rather than following what others are doing, so products are designed to solve real problems backed by science and data.

Breaking new ground: Super Patch’s defensibility comes from several sources: proprietary pattern design, the concept of VTT, registrations/clinical trials and speed to market with supporting infrastructure.

From the January/February 2026 issue of Direct Selling News magazine.