A Bilateral trade agreement could result in the elimination of Japanese tariffs on U.S. nutritional supplements, as well as serve to strengthen Japan’s direct selling market.

In our global world, free trade is critical in order to expand our markets. Last year, following the conclusion of negotiations on the U.S. Mexico, Canada Agreement (USMCA), the U.S. Government announced intentions to enter into discussions on three new trade agreements with Japan, the European Union, and a post-Brexit U.K.

High Tariffs on Supplements Have Stifled Growth

Recently, the U.S. Trade Representative (USTR) announced they would formally open a dialogue with Japan. Japan has some of the highest tariff rates on nutritional food products and supplements in the Asia-Pacific region ranging from 15%-30% for some nutritional product tariff classifications

“While Japan has just over three million sales representatives who sell via the direct selling business channel, the vast majority, 80.9% of those are women. In contrast, 73.8% of global direct sellers are women.”

While many of these tariffs were addressed in the Trans- Pacific Partnership (TPP), a now defunct trade proposal between twelve Pacific Rim countries, U.S. exporters of nutritional products continue to face high tariffs into the Japanese market.

In addition to high tariffs, Japan’s regulatory system poses a severe challenge to the import of nutritional supplement products through non-tariff barriers such as food additive restrictions and difficult rules to secure approval of functional food claims.

A bilateral trade agreement could result in the elimination of Japanese tariffs on U.S. nutritional supplements, creating more market access for increased U.S. exports. Currently, U.S. exporters of nutritional products are at a disadvantage due to Japan’s recent trade agreements with other countries such as the European Union and discussions with many of the countries which were formerly party to the TPP.

Womenomics Initiative

It’s notable that Japan’s aging population and restrictive immigration policies have severely limited the country’s ability to expand its economy. In order to stimulate growth and quickly tap into a source to expand their workforce, Japan’s Prime Minister Shinzo Abe has championed a “womenomics” initiative to boost the workforce as part of his economic reforms. While many Japanese women have entered the workforce in the past five years, many also continue to work either part-time and or from home.

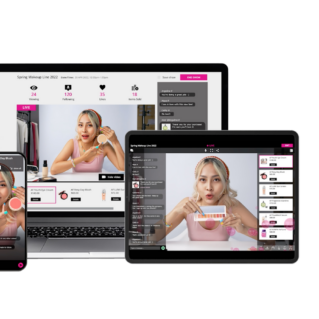

Despite being a leading economy (Japan ranks third behind the U.S. and China in GDP), Japan presents more opportunities for growth when compared to other Asian countries in terms of direct selling. While Japan has just over three million sales representatives who sell via the direct selling business channel, the vast majority, 80.9% of those are women. In contrast, 73.8% of global direct sellers are women.

Direct selling sales in Japan totaled around $15 billion in 2017, less than half of the $34 billion in sales reported in

China—a country with a much more restrictive direct selling regulatory environment. A bilateral trade agreement with Japan could serve to strengthen Japan’s direct selling market.

What Does All This Mean?

We need to engage the U.S. government as a unified industry to:

1. Encourage Japan to reduce or eliminate tariff and nontariff market barriers.

2. We need to work closely with the Japanese government to demystify direct selling and to partner with government initiatives to improve workforce sustainability.