Why mass payout platforms beat traditional banks.

In an increasingly digital world, payment processes are changing. Traditional banks are no longer the only option to meet businesses’ financial needs. Global payout platforms have become a popular alternative, offering innovative, adaptive and efficient payment solutions that keep up with our fast-paced times. This is especially true in the direct sales industry.

Direct sales companies have unique payment needs compared to other industries. They require speedy, simple international transactions on a large scale—and traditional banks don’t easily meet these needs. That’s why so many direct sales companies today have opted for more modern payment solutions.

Global payout platforms may soon become the norm for the direct sales industry. But what sets these platforms apart from traditional banks, and how do they offer a competitive edge? Let’s dive in.

A Dramatic Shift in Direct Sales Organizations

A McKinsey report projects that by 2025, global payouts could constitute up to 20 percent of direct sales companies’ total turnover, up from a mere five percent in 2010. This shift is largely attributed to the efficiency of global payout systems, which allows real-time transactions worldwide.

Another driving factor behind this change is that instant global payouts offer massive benefits for direct sales. You might think those benefits are just operational (reduced burden on HR, faster onboarding, etc.), but a closer look reveals a far broader impact. According to a report by KPMG, instant payouts have increased worker motivation by 15 percent and productivity by 20 percent in direct sales companies.

Put simply, when people are paid on time, in their preferred method and currency, the quality of their work improves. That’s why modern payout methods make a difference.

The Advantages of Global Payout Platforms

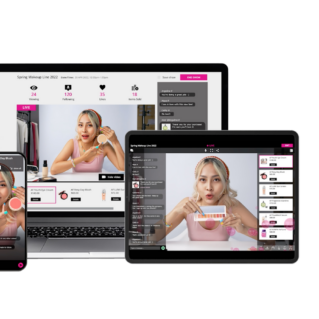

A global payout platform, or mass payout platform, is a fintech operation that allows businesses to send payments in multiple methods and multiple currencies all over the world at one time. Global payouts are ideal for paying affiliates, contractors, vendors and other team members.

While you can send an international payment through a traditional bank, most banks don’t offer the speed, convenience and global access of payout platforms. Let’s break down some of those advantages in detail.

1 / SPEED

Sixty-two percent of businesses anticipate needing real-time transactions in the future. Traditional banks often take days to process international payments. Global payout platforms can leverage innovative technologies such as Global ACH and digital prepaid cards to streamline these processes, significantly reducing transfer times.

2 / Cost-Effectiveness

Traditional payment methods, such as international wire transfers, come with hefty fees and high exchange rates. A World Bank report revealed that the global average cost of remittances stands at 6.8 percent, with banks accounting for 10.84 percent of these transaction costs. Global payout platforms offer lower fees and competitive exchange rates. They also offer a wide range of transfer methods, so savvy businesses and distributors can cut costs wherever possible.

3 / Expanding Global Access

In the direct sales industry, global expansion is the name of the game. Modern payout platforms provide simplified access to bank networks all over the world, including areas with low banking density. This allows direct sales companies to seamlessly expand into emerging economies.

4 / Adaptive Technology

Global payout platforms are driven by innovative technology. Their services constantly evolve to fit the ever-changing needs of businesses and consumers. A study by PwC found that 88 percent of consumers use at least one non-bank financial service, with 62 percent considering switching to a non-bank financial service provider if it offers enhanced convenience and cost-effectiveness. As modern payment tech continues to adapt and shape demands, traditional banks have started to fall behind, while payment platforms remain on the cutting edge.

Local Payment Options: Harnessing Opportunities for Direct Sales Organizations

The direct sales industry is going through a paradigm shift when it comes to payment options. Alongside global mass payouts, direct sales companies are increasingly choosing local payment options for their members. This reflects the understanding that catering to members’ diverse preferences and financial needs isn’t just a matter of courtesy, but a powerful driver of growth.

Here’s how local payment options, provided by custom payout platforms, offer several key advantages to direct sales companies.

1 / Enhancing Member Experience

Localized payment solutions, such as digital wallets, cash vouchers and transfers within local bank networks, support distributors all over the world by accommodating the payment methods they’re familiar with.

A study by Bain & Company found that companies offering localized payment options witnessed a 3-5 percent increase in conversion rates, suggesting that consumers prefer familiar means of payment. By making it convenient for members to conduct transactions, direct sales organizations can foster loyalty and boost distributor engagement.

2 / Boosting Financial Inclusion

With local payment options, direct sales organizations can widen their member base to include those without access to traditional banking services. Digital wallets, prepaid cards and other methods offer innovative solutions to tap into emerging markets.

According to the Global Findex Database, 1.7 Billion people worldwide remain unbanked, with many relying on alternative financial services. By accommodating these consumers, direct sales organizations stand to unlock vast new markets for expansion.

3 / Agility in the Face of Fluctuation

By offering a wide range of local payment options, modern payout platforms help to mitigate the risk of currency fluctuations. This adaptability helps companies ensure consistent, predictable payouts despite economic challenges.

4 / Encouraging Cross-Border Transactions

With traditional banks, cross-border transactions can become logistical nightmares. Payout platforms that offer localized solutions facilitate smoother international transactions, simplifying global expansion in the direct sales industry.

Embracing Change in Direct Sales Payments

Considering these benefits, it’s clear why many direct sales companies are choosing innovative payment platforms over traditional banks. Global payouts and local payment solutions make it easier for businesses to expand overseas. They offer faster, simpler, more efficient transfers with a wide range of flexible payment options.

The direct sales industry is in a period of transition when it comes to payments. As more companies embrace this change, there’s a good chance we’ll see a spike in the popularity of global payout platforms.

Robert Vanden Broecke has an impressive track record in leadership and sales, spanning 20+ years in the fintech, payments and finance industries. His niche experience with global fintech and cross-border payments brings a wealth of expertise to I-Payout and the direct selling industry.

From the April 2024 issue of Direct Selling News magazine.