7 LESSONS LEARNED: The blueprint you need after Neora’s landmark victory

Compliance has long been considered an obligation, much like taxes and insurance, but there is power in building a company culture that reinforces and emphasizes compliance. A healthy compliance strategy shields companies from legal and regulatory offenses; reduces the prevalence of damaging and false information online; and prevents rogue sellers.

More importantly, a company that prioritizes compliant behaviors in its corporate and field teams can’t help but steep itself in the integrity-focused behaviors that bolster consumer confidence.

“Compliance is not the enemy,” said Heather Chastain, Bridgehead Collective Founder and CEO. “When we embrace the idea of compliance, it not only protects us, it helps us build a stronger business. We need to flip the script and normalize it as a foundational business requirement. Compliance is not a separate entity to be navigated. It’s something we need to champion.”

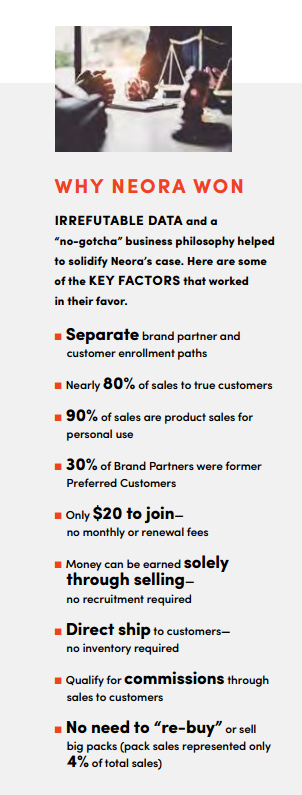

The need for hearty and consistent compliance has never been more urgent. In analyzing Neora’s seven-year battle against the Federal Trade Commission (FTC), the company’s approach to compliance was given significant weight as one of the key factors in their victory. In fact, the judge’s ruling specifically cited what it called Neora’s “rigorous” and “robust” compliance program as a reason why the FTC’s requested injunction was not warranted.

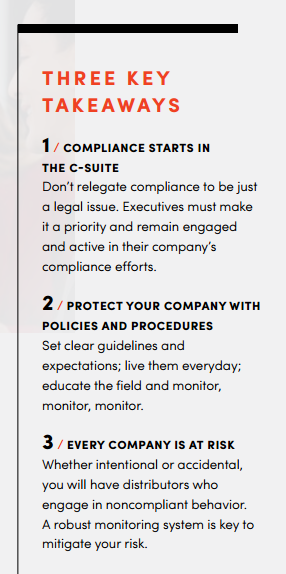

While every legitimate direct selling company already has an active compliance department, it’s one that is often compartmentalized or buried within the legal division. To be truly effective, compliance must be a C-Suite issue that is viewed and implemented as a company-wide initiative. Achieving this culture shift starts with amassing and analyzing information and then taking a hard look at what it is saying about business structure, financial compensation, purchasing trends and customer satisfaction.

“Most direct selling companies have detailed business intelligence data, but many do not know what story the data is telling,” said Katrina Eash, Partner at the Winston and Strawn Law Firm. “For instance, does the data show that your company—like Neora—has very high end-user consumption by consumers that isn’t tied to a compensation plan? If so, you are well on your way to proving you are not a pyramid scheme. Likewise, most direct selling companies have compliance policies and teams to enforce those policies. But what companies often overlook is whether their compliance teams are operating effectively to monitor, identify and correct noncompliant behavior. The second step is just as vital as the first to reducing your company’s exposure.”

7 Must-Haves From Neora’s Landmark Victory

Neora’s ultimate win against the FTC provided a never-before-seen roadmap for direct selling companies. Previously, all government guidance was cloaked in vague language with no clear rules for what regulators deemed compliant. And while Neora’s win does not extend protections to the entire industry, it does provide actionable precedents for leaders to emulate.

Following Neora’s legal encounter with the FTC, Direct Selling News analyzed the judge’s final ruling to discover the elements that were deemed important in a court of law. The result is a seven-part checklist that provides the keys to Neora’s decisive victory—these are the new non-negotiables for all direct selling companies seeking to operate with regulatory integrity.

1 / Draft clear policies & procedures

Distributors enter the sales field with varying degrees of knowledge about what they can and can’t say regarding product and income claims. Crafting a thorough policies and procedures document—Neora’s is a hefty 29 pages—helps set expectations for behavior both in person and online. When an infraction occurs, the established policies pave the way for resolving the issue quickly and ultimately expelling repeat offenders. For Neora, that looks like enlisting internal departments to assist distributors in developing compliant marketing resources and treating all Brand Partners equally regardless of rank.

“Our goal first is to educate, not punish,” said Deborah K. Heisz, Neora Co-Chief Executive Officer. “We monitor what people do, and when we find them out of compliance, we don’t just send them a letter to take it down; we coach them on why it’s non-compliant and how to fix it.”

2 / Constantly review data

Always keep records. Neora’s compliance director ended up being a witness at trial because of the company’s commitment to maintaining thorough data and reviewing it at quarterly meetings as a staple of its corporate culture. When the FTC began making claims against the company, they were ready with hard numbers on everything from customer sales to individual distributor compliance violations.

The structure of some companies make it difficult to compile this data, but strides must be made in the near future to correct that deficit.

3 / Customer sales must be robust

Sales to customers that are not in any way connected to the compensation plan are crucial but not enough—companies need to be able to demonstrate this as well. Because Neora clearly delineates between its Brand Partners and customers, they had ready access to customer information when their legal battle required it and could prove that the purchases were delivered to customers’ residences. According to the ruling, Neora’s record also illustrated that a lion’s share of its sales came from existing customers—i.e., regulars who love the products—rather than through the continual enrollment of new customers. This established true market need.

“This data was critical to us in winning,” Heisz explained. “If you don’t have customer sales—and you won’t if you don’t incentivize your field to sell to customers—then you’re not going to pass the test.”

4 / Recruiting can’t be required

A forced purchase environment has no place in direct selling. Distributors must be allowed to earn commissions and rank up without making monthly purchases themselves. Distributors shouldn’t be required to build a team or recruit others to earn an income. Programs that reward distributors for customer sales are an essential component to a company’s overall growth.

5 / Know why your Distributors buy

Neora conducted a survey to determine the reasons why its consumers were buying its products, and the results were surprising. Many Brand Partners pointed to the product discounts; their love of the product; and even the community they found at Neora. Making money did not make the top of the list.

This was important during the court trial when the FTC’s expert witness claimed that all purchases made by Brand Partners had to be attributed to a desire to participate in a business opportunity. Because of Neora’s survey and its 2021 data showing that 30 percent of Brand Partners were former Preferred Customers, the judge rejected the FTC’s assumptions, saying: “We may walk away poorer than we started after a trip to the grocery store, but because we obtained valuable goods or services in return for our money, that exchange is not characterized as a loss.”

6 / Quality products at market prices

Products must be the foundation for every direct selling company moving forward, and those products need to be of high quality at a reasonable price point. The days of heavily cushioned profit margins are in the rearview mirror as Amazon and big box retailers make finding and comparing products easier and more cost-effective than ever before. It’s difficult to argue consumer demand when you are selling a product that could easily be purchased for 40 percent less elsewhere.

Products must demonstrate viable consumer demand regardless of whether they are attached to a business opportunity.

7 / Play fair

Operating in a way that eliminates hidden fees, fine print and “gotchas” must become business as usual for direct selling companies. Neora demonstrates this in several ways: a low sign-up fee; no renewal fees; and no monthly charges for access to their back-office platform.

“Be fair and honest and don’t hit people with a hidden fee or some task they have to do to build a business,” Heisz shared. “We don’t ask Brand Partners to spend money out of their own pockets every month, and they can make money without recruiting a single person. We try to make sure our program is fair for everyone.”

Every Company Is at Risk of Litigation

Once a company has established robust policies and procedures, ongoing monitoring of field representatives is essential. This can feel like a gigantic, overwhelming task given the many social platforms where noncompliant content can exist, but there are digital compliance programs that can make the process more feasible. In Neora’s case, FieldWatch, an internet-wide monitoring program that identifies potential violations and tracks repeat offenders, was a fundamental part of their victory.

And while a cursory search may lead company leaders to believe that compliance is a non-issue for them, Travis Wilson, Director of Business Development at FieldWatch, says that—in his experience—every company has violations.

“Companies without monitoring put themselves at risk,” Wilson said. “Whether it’s problematic content going out to the internet or a company culture of not policing itself, companies who aren’t working to identify and remove noncompliant content across platforms are creating an atmosphere that will almost certainly result in problems down the line.”

In its pursuit of Neora, the FTC conceded that the internet is a big place, and that it would be unreasonable for every offending post or mention of a company to be spotted and resolved. However, the commission laid out a clear expectation that companies are responsible for actively monitoring representatives who claim to be speaking on their behalf—from corporate statements to Instagram reels made by rookie distributors.

Monitoring is now a critical component of a healthy compliance program. Without it, companies are not only without defensive evidence in the case of litigation, they are unable to fully protect customers. The old school version of compliance—the one that tucked it away in the legal department as an afterthought—is inconsistent with an industry that was built to serve through effective products and attainable opportunity. It will be the companies who choose to take ownership of their compliance efforts, purchasing facts and customer protections who will now become the leaders of the future.

“Understanding the story your business intelligence data is telling and auditing your compliance function are two primary areas that direct selling companies should focus on in 2024 to build a higher integrity model that will help reduce regulatory and litigation exposure,” Eash said. “The Neora decision emphasized the importance of both in proving the legitimacy of a direct selling company.”

THE KEY QUESTIONS TO ASK YOURSELF

from Deborah K. Heisz / NEORA

No one wants to have the FTC knocking at their door—it’s imperative that you be proactive. Consider building a relationship with legislators and take steps now to protect yourself later. Deborah K. Heisz, Neora’s Co-CEO shared these questions you should ask yourself today.

- Do I have a robust, documented, enforced compliance program?

- Would people buy my product if there was no compensation plan attached?

- Do I have the data to demonstrate real consumer demand?

- Does my compensation plan incentivize distributors selling product to end users?

- Can I demonstrate that distributor purchases are for personal consumption?

- Does my compensation structure rely on ongoing consumer purchases (not pack sales)?

- Do my policies and procedures treat distributors like independent contractors—not agents or employees?

- Do i have the data to fight?

Regulatory Red Flags and Practical Fixes

The top 10 ways companies leave themselves open to litigation and how they can proactively protect themselves.

From Heather Chastain / Bridgehead Collective

To help leaders and sales teams overcome false narratives and non-compliant habits, Heather Chastain, Founder and CEO of Bridgehead Collective, built a risk assessment test based on the precedents set in Neora’s historic win.

But while the ruling provides valuable benchmarks, it’s not a wholesale win for the channel. As she explained, “Companies should be grateful for the framework the ruling supplied, but this ruling requires that you understand your data and can stand up to the same scrutiny as Neora.”

Bridgehead Collective’s 20-part test helps leaders identify the areas that need the most improvement and—for the first time—presents a court-tested yardstick by which companies can learn how their own processes measure up.

- Compensation Plan Structure and Red Flags

- Costs to Join / Expenses to Build a Business

- Customer-to-Distributor Ratio

- Preferred Customer Programs, Intent of Membership and Reclassification Programs

- Compliance Program – Field Facing and Internal Processes and Support

- Income Claims

- Autoship

- Returns

- Refunds

- Forward Progress

Want to know if your company can stand up to the scrutiny?

Schedule your Compliance Checklist Assessment today, complimentary for DSN Gold and Platinum Supporters.

From the April 2024 issue of Direct Selling News magazine.