Direct Selling Capital Advisors’ Stock Watch May 2021

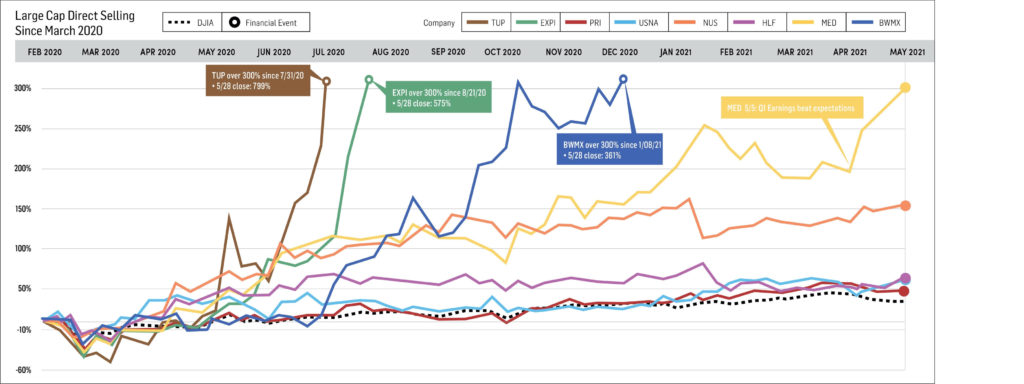

May saw a surge in direct selling stocks, driven by a strong first quarter, which included aggregate growth revenue of more than 63 percent among the Direct Selling Capital Advisors (DSCA) large cap tracking set. The Direct Selling Capital Advisors Direct Selling Index (DSCI) rose 18.4 percent during the month, as compared to a gain of 1.9 percent for the Dow Jones Industrial Average (DJIA).

These gains have led the DSCI to sit at a record high, up 111 percent since the tracking period began on March 1, 2020. This is compared to a gain of 35.9 percent for the DJIA during the same period. Year-to-date, the DSCI is also outperforming the broader markets with gains of 33.5 percent, while the DJIA gains 14.2 percent.

“May represented one of the strongest monthly performance periods for direct selling stocks since the inception of our tracking set in March 2020,” said Stuart Johnson, Direct Selling Capital Advisors CEO. “Particularly impressive was the manner in which it occurred, which was primarily without the support of the broader markets. The relative strength is not necessarily surprising; however, the dramatic spread is certainly impressive.”

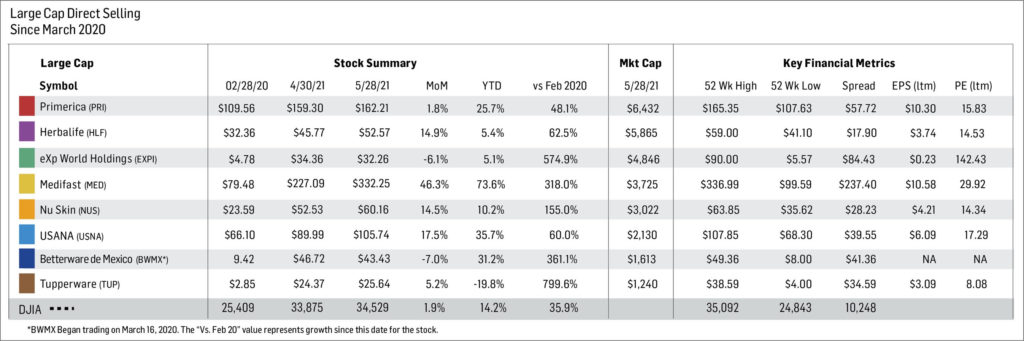

Large Cap Stocks

Each of the eight large cap stocks within the tracking set outperformed the broader markets since tracking began. Only two companies declined, but both have experienced noteworthy runs during the year.

- Medifast, Inc. (NYSE: MED) rose 46.3 percent, driven by the company’s first quarter financial results announcement, which included revenue growth of 91 percent, year-over-year. At the end of May, MED stands up 318 percent since tracking began and includes gains of 73.6 percent in 2021 year-to-date, making it the clear leader in the group.

- USANA Health Sciences, Inc. (NYSE: USNA) rose 17.5 percent and now stands 60% above its February 2020 levels. With 2021 gains of 35.7 percent, it is the second leading company in the large cap tracking set.

- Herbalife Nutrition, Inc. (NYSE: HLF) moved aggressively higher after impressive first quarter results and increased 14.9 percent throughout May. HLF is now 62.5 percent above its initial tracking date levels, but continues to lag somewhat with gains of only 5.4 percent for the year.

- Nu Skin Enterprises, Inc. (NYSE: NUS) rose 14.5 percent and now stands 155 percent above the initial tracking date. Year-over-year revenue growth of 31 percent announced in its first quarter results created a continued upward trend and a near-record 52-week high before selling off slightly in early June.

- Betterware de Mexico (NASDAQ: BWMX) declined 7 percent and now stands 31.2 percent higher since the beginning of the year and 361 percent higher than March 2020. The company’s first quarter financial results included net sales growth of 205 percent year-over-year, leading the stock to trade off slightly and it has since been trading in a sideways to slightly down consolidating pattern since then.

- Tupperware Brands Corporation (NYSE: TUP) rose 5.2 percent and is now 800 percent up since the end of February 2020. TUP has become a remarkable turnaround story and became a top performer in 2020, but has lagged behind in 2021, standing down nearly 20 percent year-to-date as of the end of May. The stock is trading in a general downward trend, possibly an indication of profit taking after the stock’s impressive run last year.

- eXp World Holdings (NASDAQ: EXPI) lost approximately 6 percent during the period, but despite declines over the last several months, the stock remains up 5.1 percent year-to-date and 574.9 percent since the initial tracking period began.

- Primerica, Inc. (NYSE: PRI) rose 1.8 percent during May, and now stands 48.1 percent higher than its initial levels, and 25.7 percent up year-to-date. On May 5, the stock set a new 52-week high following strong first quarter financial results, which included 21 percent year-over-year revenue growth, and set a new 52-week high again in early June.

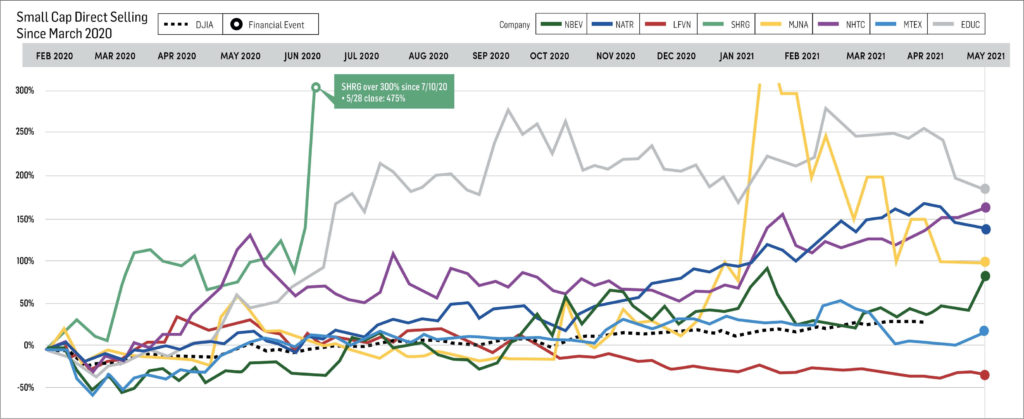

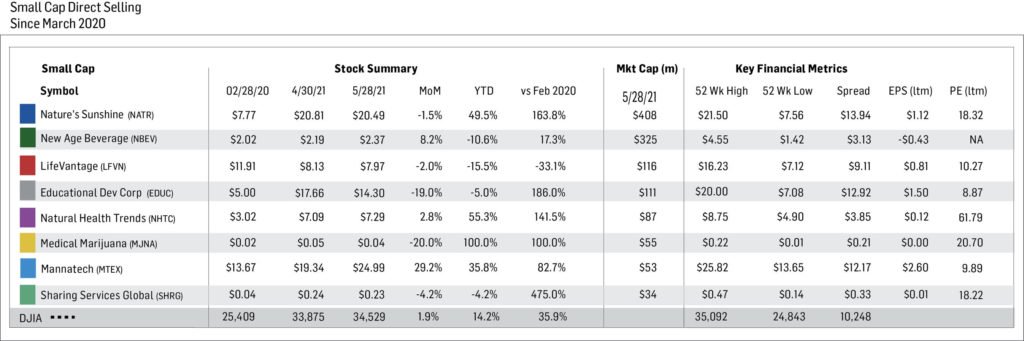

Small Cap Stocks

Mannatech Incorporated (NASDAQ: MTEX) gained 29.2 percent in May, and then began a process that seems to clearly indicate they are in the process of preparing for a “go-private” transaction. After several years of repurchasing shares, the company announced a tender offer to purchase up to 211,538 of its shares at a price of $26, representing a premium of nearly 28 percent to the stock’s closing price in the previous session. This tender off represents more than 10 percent of shares outstanding, and insiders currently hold more than 48 percent of the stock, which will likely exceed 50 percent of the total following the completion of the offer.

Short Interest Data & Analysis

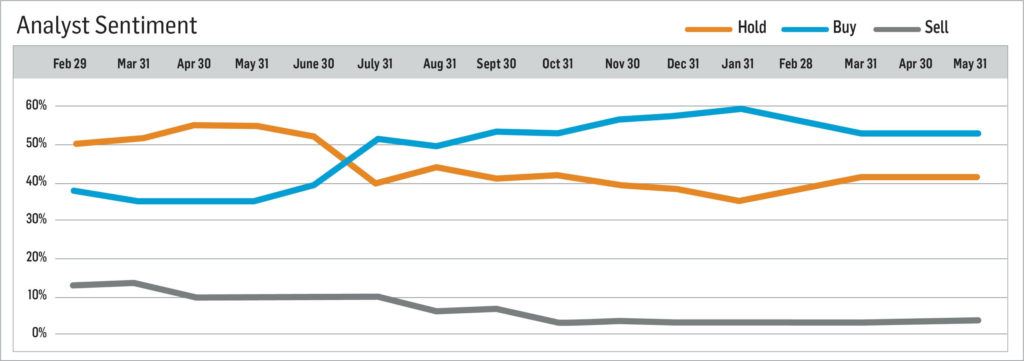

During the month of May, the number of sell-side analysts maintaining “buy” and “hold” ratings on industry stocks remained flat at approximately 97 percent. Analysts recommending “sell” ratings remained miniscule.

“Second quarter of 2021 results are where things will get interesting,” Johnson said. “While first quarter results were very impressive, the year-over-year comparable period did not include the pandemic period trends that helped to launch the current growth cycle the industry is experiencing. However, by the second quarter of 2020 these trends had begun to take root and positively impact results in many cases. As such, the upcoming second quarter results will have a much higher hurdle to jump for many companies to continue to show significant YoY growth.”

Analysis brought to you by:

Direct Selling Capital Advisors (formerly Transformation Capital) provides monthly market analysis abased on research and the TDSI index. The TDSI is a market capitalization weighted index of all domestic public direct selling companies with a market capitalization of at least $25 million.