The Differentiators of the Ones to Watch

In any given year 1,100 direct selling companies do business in the United States. They span the gamut from generationally successful big legacy names to mid-sized companies and then the tiniest of startups, who want to capitalize on momentum and seal their brands in direct selling history, too.

Legacy brands and mid-sized companies stand up to be counted rather easily within the industry, but it’s much harder to know exactly how many startups are on the proverbial horizon. Without much fanfare, founders sit around kitchen tables planning; tinker in labs with new product formulas; and spend countless travel days recruiting until finally they launch their entrepreneurial dreams and vision into the direct selling marketplace.

Regardless of their product categories, depth of bankroll or on-point messaging, direct selling startups—like all small businesses—face battering headwinds. But every year, some statistical outliers strategically beat back those headwinds to find their market fit, hit their margins and survive hypergrowth to begin the long-game of a mid-sized direct selling company.

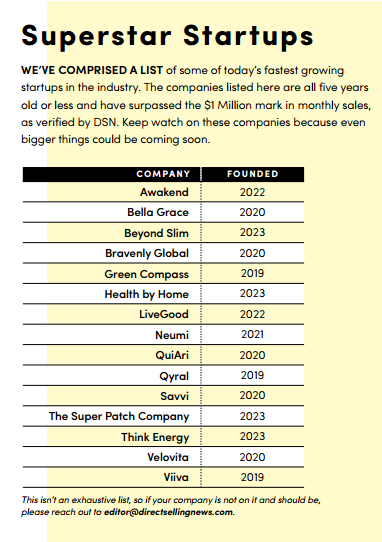

Direct Selling News (DSN) comprised a list of the most successful of these fledgling companies—the ones to watch. We snapshot a few of their stories here. To qualify, each company must be five years old or younger and have verifiable monthly sales surpassing the $1 Million mark. This isn’t an exhaustive list, so if your company is not on it and should be, please reach out to editor@directsellingnews.com.

To be sure, a list like this is where every startup wants to find themselves one, two or five years from launch. But if it was easy, everyone could do it, right?

Sources of inspiration and opportunity for startups are seemingly endless in this marketplace, especially with the accelerating power of artificial intelligence in the mix. But the window for success, at least in the US market, is shortening every day because people are always looking for the next big thing.

“One of the greatest challenges for any direct sales company is, First ‘How do I get hot?.’ Second, when I become hot, ‘How long can I sustain it?.’ But inevitably, they’re going to cool off. Success really lies in what you figure out how to do once you cool off. Because you’ll either flash in the pan or you’ll actually leverage all that stuff you have very little control over and turn that into a business. That’s the magic to a start up!” Brett Duncan, partner with Strategic Choice Partners, a direct selling industry consulting firm, explained.

Doubling Down on Field Development, Controlled Growth, Leadership

“One of the greatest perks you have as a startup is that you aren’t big. So, you have that moment to connect with your salesforce. Does it take time? Yes. Does it sometimes feel unproductive when you’re just having a one-on-one chat with someone early on? Yeah, it does. But planting that seed, a lot of times, bears so much fruit down the road,” Duncan said.

So, if field development and management is not in your DNA as a startup founder or executive, it’s essential to partner with someone who can step in and do that. “That’s of the utmost important,” Duncan added.

Is controlled growth possible in an industry as volatile as direct selling? That’s a matter of debate. Stories of hockey stick growth and momentum can be a magnet, but hypergrowth highs plumet leaving startups vulnerable if they’ve overcompensated. The companies that endure are the ones that have a really healthy balance in terms of expenses and investment vs. results.

And when a company starts doing well, leadership needs change. It doesn’t mean the company no longer needs what they had; it means they need a lot more. Direct selling companies often find themselves caught between the startup fun they had when every decision was filled with entrepreneurial inspiration and their need for strategic leadership as they scale.

When companies struggle, often a big part of that sits with founders who haven’t yet figured out how to think ahead in terms of leadership and hire to the challenges the company faces, while also balancing who they are. This may mean the founder’s role needs to change. Figuring this out, Duncan said, might be the biggest differentiator of all.

Snapshots in Startup Success

THINK ENERGY

Michael Fallquist, Founder and CEO, knows well the challenges and successes energy companies in direct selling face. There are many case studies of very successful ones including Viridian Energy, which he founded; and in January 2023, Fallquist once again stepped into the marketplace with Think+, the sales channel of retail electricity provider Think Energy. “Think+ is built to surpass all of their successes,” Fallquist said.

Think+’s mission is to make clean energy simple, easy, and affordable for everyone. And in just over a year, they’ve established a strong base of over 6,500 Energy Advisors; reached their operations into every deregulated energy market in the US; expanded into every community solar market in the country; and began beta testing their proprietary Think Smart app in multiple states.

“Technology is essential for us to deliver value to our customers. Our proprietary Think Smart app empowers our customers to earn cash back by making better energy choices,” Fallquist shared.

Powered by a its technology platform, Proton, Think Smart is a smart meter integrated billing system and is proving to be a core differentiator for the company in the short- and long-term.

Think+ sets itself apart from the competition by focusing its product offerings on electricity and community solar and by leveraging tech. And in doing so, they empower customers to take control of one of the most significant of household expenses—energy.

Long-term fixed electricity rates with no early termination fees mean customers win when rates go up or down. Customers win again with community solar, which provides savings between five and 25 percent on energy costs for up to 20 years. And the Think Smart app earns customers cash back on electricity bills by empowering customers to make better daily energy choices and referring friends and family to the Free Energy Club.

“Customers can earn cash rebates for up to 100 percent of their Think Energy supply charges by referring other customers. What has made this program so successful is that we give cash rebates with as few as three customers,” Fallquist explained. As part of the program, three referrals unlock a 10 percent rebate, while 10 customers is 40 percent and 20 customers is 100 percent.

Bravenly Global

Upon their launch in late 2020, Bravenly Global focused on building trust belly-to-belly and heart-to-heart. They’re family owned and operated—with Founder and CEO Aspen Emry, her husband, five kids and now grandchildren pitching in and traversing the country, meeting with field leaders and training them in pursuit of their dreams through health and wellness.

Known within their field for transparency—a key factor that has earned them much trust as a startup—Bravenly consciously over communicates with their Brand Partners. “They know we face challenges head on and do not sweep things under the rug. They know that we make all things right, but that we won’t hide behind anything tough or changes that come our way,” Emry said. “We do life together. We are building our lives together. No one wonders where we stand.”

Bravenly’s low-key customer acquisition strategy relies on honest results echoed through social media, where they’ve cultivated relationships and established community. “We don’t make wild claims,” Emry said. “Our customers naturally upsell themselves.”

This year they plan to expand email marketing and provide more value-added content to their community through recipe guides and other healthy lifestyle tips that complement Bravenly product usage.

Bravenly reports consistent growth since inception three years ago and boasts a trusting partnership with manufacturers, too. “They understand our company and have been with us when we 10x our sales over the course of 100 days at one point,” Emry said.

“We have created models that help us predict hypergrowth inventory needs. And paired with our previous field experience, we have been able to go off our business intuition for some parts of growth. By strategically planning for all the what ifs and learning from our former, traditional business experience prior to founding Bravenly, we have been able to manage growth quite well,” Emry explained.

QuiAri

The best way to describe QuiAri’s first years in business—founded October 2019, just months before the pandemic—is “controlled urgency.” Founder and CEO Bob Reina launched QuiAri all at once, in over 100 countries with breakthrough products derived from a newly discovered anti-aging superfruit, maqui.

Maqui set QuiAri apart from its product competition in the direct selling health and wellness space, but the fastest pay out compensation plan in the industry (every five minutes, globally) went to work immediately boosting promoter numbers.

“Despite opening near the beginning of the pandemic being a startup worked to our advantage. We could be nimble and adapt to challenges. We never encountered a problem that didn’t have a solution and facing challenges together only made us stronger as a team,” Reina recalled.

QuiAri established a “whatever-it-takes” culture, embodied by their equally innovative and effective IT Team, who invented global 5-Minute Pay and built all the company’s digital features based on real-time customer behaviors and localization of services.

But the company’s technological innovations also apply to product manufacturing. QuiAri replaced heat- and preservative-based ingredient processing with high-pressure processing (HPP) that preserves maximum nutrient content, taste and texture without sacrificing quality.

“We knew that once people tried our products, they would fall in love with the results and then share them with others,” Reina said.

QuiAri was recently named by DSN as one of just 23 companies with four consecutive years of growth, based in part on its product exclusivity and pay-out innovations. “Our sales did not level off after the height of the pandemic; they increased,” Reina said.

“We are just beginning to experience hypergrowth, and it is something we fully embrace. Since we have a rock-solid infrastructure and an executive team with a combined 500+ years of MLM experience, we are prepared for explosive growth and can scale up quite easily. If there happens to be an obstacle standing in our way, one of our experts already has an effective plan to remove it,” Reina concluded.

Qyral

Founder and CEO Hanieh Sigari envisions the democratization of medicine thanks to artificial intelligence, hyper personalization and telehealth. Her inspiration for Qyral struck in 2018, then COVID brought these theories into sharp relief as the company tested many hypotheses; found their market fit; and created an infrastructure that prioritized future growth and support. The goal? Add decades to people’s lives—and make them look and feel amazing in the process.

Qyral launched with a non-prescription grade, personalized skincare line, followed by teledermatology and prescription-grade products. Data told them to stay in the aesthetic vertical market and avoid quick expansion, but anecdotal input and Sigari’s intuition said different.

Soon, compounded GLP-1 medications aimed at weight management became part of Qyral’s mission to increase longevity. “We decided to trust our instincts and launched a waitlist that required a deposit to join. To our delight, the demand was incredible and affirmed we’d made the right decision,” she said.

Qyral offers what Sigari calls the ultimate in exclusive products, due to their hyperfocus on personalization. The company’s ambition reflects the endless possibilities that space offers: bioidentical hormone replacements therapies, peptides, nutritional supplements and more.

She believes the most successful companies know their own limitations, understand when to outsource and make customer service a top priority. For Qyral, that meant establishing partnerships with compounding pharmacies, spending two years building strategic operations capable of rapid growth, and then accelerating their telehealth model—all of which gave them the ability to scale to tens of thousands of orders per day without having to take on the capital-intensive risk of expansion.

“We’ve only just scratched the surface of what’s possible, and we won’t stop until we’ve transformed the way we all think about our health, wellness and longevity,” Sigari said.

Keeping Watch for Startup Headwinds

All startups face headwinds. The most successful keep upright during even the toughest storms by strategically planning for them long before they are on the radar.

Brett Duncan, partner with Strategic Choice Partners, a direct selling industry consulting firm, sits down to the table with direct selling companies of all sizes to help them face challenges. Sometimes people call with just a spark of inspiration before initial business planning has even begun; others find themselves in the middle of a “holy crap” moment weeks before launch or wading through overlooked necessities years later.

Headwind 1 / Commitment to the Channel

Duncan’s group fields calls from businesses unfamiliar with the direct selling industry that decide they want to add a direct selling channel. This is a big hurdle to clear.

“If you haven’t led a sales force like this before, the biggest headwind is that you’re underestimating what it’s going to take in terms of both time and patience,” Duncan said. “All those dynamics, if you’re experiencing them for the first time as an owner of a direct selling company—that’s a lot to learn. The solution is to go find someone who’s done it and bring them in. The other solution to that is: don’t do it.”

Developing and managing a direct sales field isn’t something that can be done halfway. Many companies that think they want to expand into direct selling simply aren’t committed enough to the channel. Often, they don’t really need or want to be a direct selling company. Instead, they should manufacture for a direct sales company.

Headwind 2 / Margins

In the rush to get a product to market, startups can miscalculate what it means to have a solid cost-to-retail price mark up. Regret lies in 4x or 5x. Think all of this will work out down the road? Not likely, when normal margins are 7x or 8x. “It’s really hard to fix that later,” Duncan said.

Headwind 3 / Top Leader Activity Requirements

“We work with a lot of companies who realize (10 years down the road) they are paying a lot of money to a lot of people who aren’t doing anything anymore, and it’s hard to roll that back,” Duncan shared.

But it can very easily be addressed by having some clear activity requirements from the beginning. As leaders develop and their business grows, expectations will be clear—then that headwind won’t come crashing in.

Headwind 4 / Funding

Once upon a time when direct selling companies basically shipped product, mailed checks and let the field do the rest, it was possible to bootstrap a startup. That’s less plausible these days.

“It doesn’t mean you can’t, but a lot of companies go into it thinking they will just sell their way to success. Companies have to do so much more now, and that stuff costs money,” Duncan explained.

Headwind 5 / Compliance

Eager to launch and get off the ground, some startups can adopt less than stellar habits when it comes to compliance, thinking they will fix it later. Sometimes it becomes a back-burner situation; more often it comes down to lack of enforcement of existing policies.

“God willing you make it to 10 or 20 years, if you haven’t been enforcing your policies, you will someday be sitting there saying, ‘We’ve got to enforce our policies!’” Duncan said.

That’s a tough, cultural ask of leaders, who are largely responsible for your company’s success. They can feel cut off at the knees if the news comes late in the game. But it’s not so tough at the beginning to safeguard a company’s future and adhere to compliance.

From the April 2024 issue of Direct Selling News magazine.