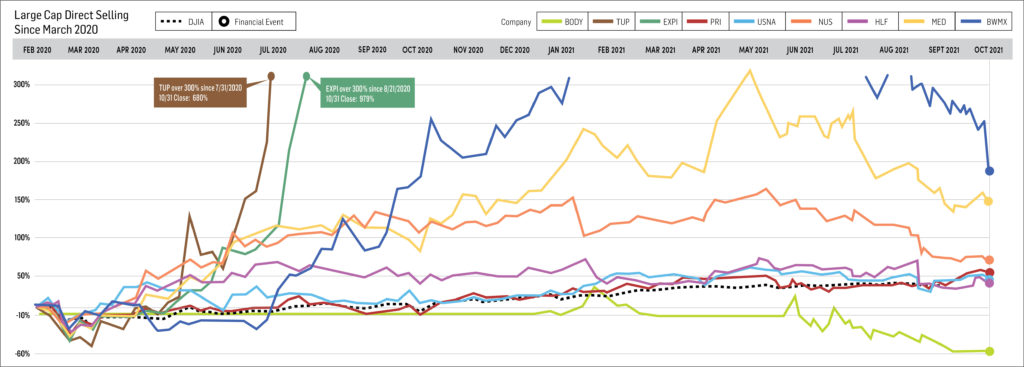

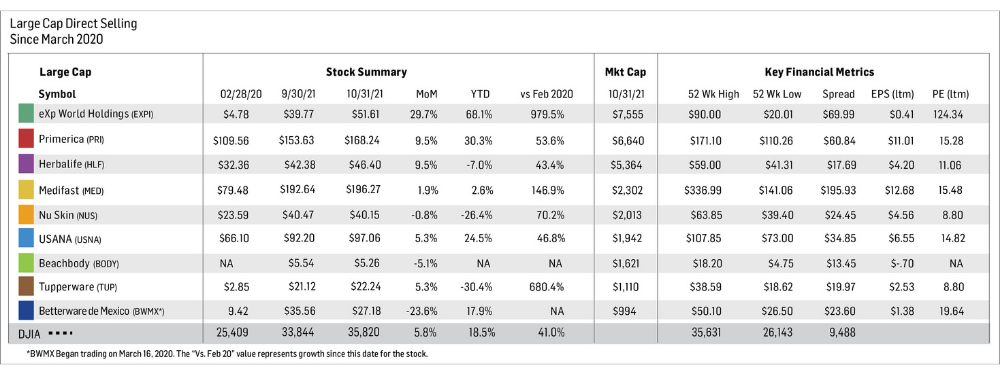

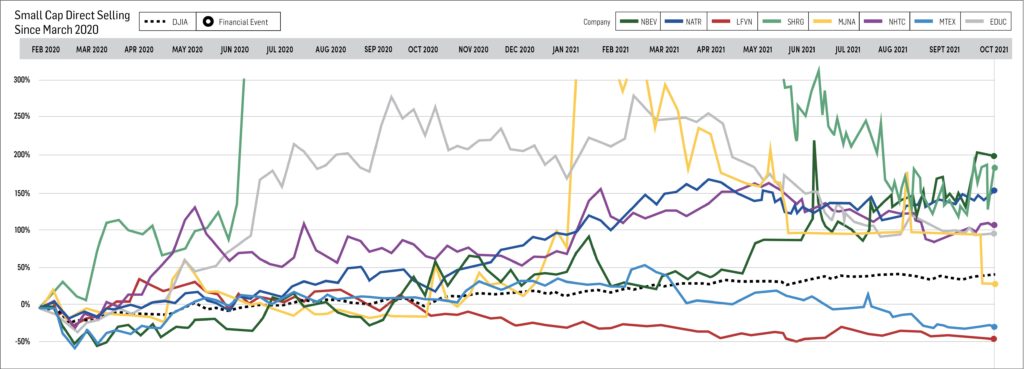

The Direct Selling Capital Advisors Direct Selling Index (DSCI) rose 10% in October, partially reversing a three-month decline that had cut the index’s value by a cumulative 30%. This strengthening was fairly consistent among the index members, with six of the nine large cap stocks and seven of the eight small cap stocks improving. With this rise, the DSCI outperformed the Dow Jones Industrial Average (DJIA), which gained 5.8% during October.

Since March 1, 2020, when the index tracking set began, the DSCI has gained a cumulative 74.5%, while the DJIA has gained 41% during the same period. Year to date, the DSCI has appreciated 10.4%, while the DJIA has gained 18.5%.

The earnings reporting season has gotten off to a mixed start for DSCI component companies. eXp World Holdings, Inc. and Medifast, Inc. (NYSE: MED) each reported robust third quarter revenue growth. On the other hand, BWMX, Tupperware Brands Corporation (NYSE: TUP) and Nu Skin Enterprises, Inc. (NYSE: NUS) announced somewhat disappointing results. Lingering effects of the COVID-19 pandemic impacted sales at all three companies. In addition, exceptionally strong year-ago comparable periods impacted results on a relative basis.

Large Cap Stocks

- Betterware de Mexico (NASDAQ: BWMX) fell 23.6% in October, causing it to lag behind other large cap DSCI components. The company’s third quarter results showed sluggish growth compared to its reports from 2020 and the first half of 2021. Like many of the other stocks, year-over-year comparisons to its outstanding performance in the same quarter of 2020 have caused a significant impact on perceived performance. BWMX’s stock price is down 17.9% since the start of 2021.

- Tupperware Brands Corporation (NYSE: TUP) gained 5.3% in October, cutting its year-to-date losses to 30.4%. Since the beginning of the tracking set, TUP shares have gained an astonishing 680.4%. While the company reported mixed third quarter results, the company’s EPS was $1.19, and well above consensus analysts’ estimates of $0.71 per share. Sales did decline 11% in the third quarter versus last year, due in part to persistent negative effects of the COVID-19 pandemic.

- Nu Skin Enterprises, Inc. (NYSE: NUS) was the highest dividend yielding stock in the DSCI (3.73%), but underperformed the DSCI in October, declining 0.8%. Shares are down 26.4% in the first ten months of 2021 but are still up 70.2% since the March 2020 establishment of the DSCI. The company’s third quarter results reduced its full-year 2021 EPS guidance to $3.93-$4.03 from $4.30-$4.50, and third quarter revenue was down 9% from same quarter last year, shifts that are attributed in part to pandemic disruptions of selling and promotional activities in several markets, most importantly Mainland China and Southeast Asia.

- Herbalife Nutrition, Inc. (NYSE: HLF) reported third quarter results in line with the quarterly guidance it issued on September 13. Net sales were down 6% from the same quarter in 2020 to $1.4 billion and lingering effects of the pandemic impacted activity among its independent distributors. Adjusted diluted EPS was $1.21 in the quarter, up from $1.15 in the year-ago period, allowing Herbalife to maintain its full year 2021 adjusted diluted EPS guidance of $4.55-$4.95 per share. HLF shares increased 9.5% in October, which cut its year-to-date loss to 7%, and have appreciated 43.4% overall since March 2020.

- Medifast, Inc. (NYSE: MED) shares improved modestly (+1.9%) in October, reversing a small portion of its approximate 35% decline in August and September combined. Year to date, MED has gained 2.6% and 146.9% since March 1, 2020. The company’s third quarter financial report was strong, showing increases in revenue (52%) and diluted EPS (22%) over the third quarter of 2020. As a result, the company has increased the midpoint of its full year 2021 revenue and EPS guidance by 3.1% and 1.3%, respectively. MED stock was up approximately 13% on a November month-to-date basis as of its November 5th closing price.

- USANA Health Sciences, Inc. (NYSE: USNA) beat analysts’ expectations with its third quarter revenues and earnings, even though both measures declined when compared to last year’s results. Sales in the quarter were down 8.1% ($274.4 million) and EPS was $1.36 versus $1.44 from the third quarter of 2020, as COVID-19-related disruptions and lockdowns in several key markets affected the company’s ability to operate and ship products. The company’s shares rose 5.3% in October and have gained 24.5% since January 1, 2021, creating an overall appreciation of 46.8% since the tracking set began and beating the Dow’s 41% cumulative increase.

- eXp World Holdings, Inc. (NASDAQ: EXPI) increased 29.7% in October, bringing its year-to-date gain to 68.1%. Since the tracking set began on March 1, 2020, EXPI has rallied an unparalleled 979.5%. The company’s third quarter results were also robust, with net sales and residential transaction volume during the quarter nearly doubling the previous year’s third quarter totals. The key driver for EXPI appears to be that the total number of EXPI agents increased 82% in the third quarter of 2021 from third quarter 2020 levels. Adjusted EBITDA for the company was $23.1 million in the quarter, up 6% from the second quarter of 2021.

- Primerica, Inc. (NYSE: PRI) is the largest market cap stock in the DSCI and performed approximately in line with the index in October, rising 9.5%. Year to date, the stock has appreciated 30.3%, and is 53.6% higher than its March 2020 levels. The company’s second quarter results, reported in early August, showed that revenue and earnings per diluted share increased 25% and 28%, respectively, versus the same quarter of 2020.

- The Beachbody Company, Inc. (NYSE: BODY) was one of the three large cap constituents of the DSCI to decline in October (-5.1%). On November 1, Beachbody announced that Jean-Michel Fournier, the former CEO of a well-known media company, will lead its global partnership and international development efforts.

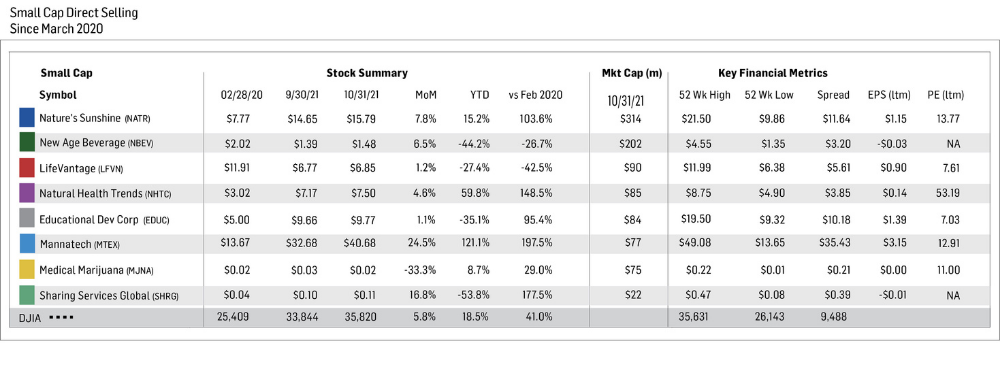

Small Cap Stocks

The small cap tracking set saw a solid October, as seven of the eight component stock prices rose.

- Mannatech, Incorporated (NASDAQ: MTEX) was the best small cap performer in October with a 24.5% increase. The stock appreciated 121.1% in the first ten months of 2021, and 197.5% since the DSCI’s inception.

Short Interest Data and Analysis

Short Interest in industry stocks moved higher in October after a slight downturn in September. Aggregate “days-to-cover” have increased around 150% since bottoming in mid-February and is at its highest level since the index tracking set began in March 2020. This statistic does mean more investors are betting DSCI stocks will decline, but it also provides significant buying power that can accelerate any move higher.

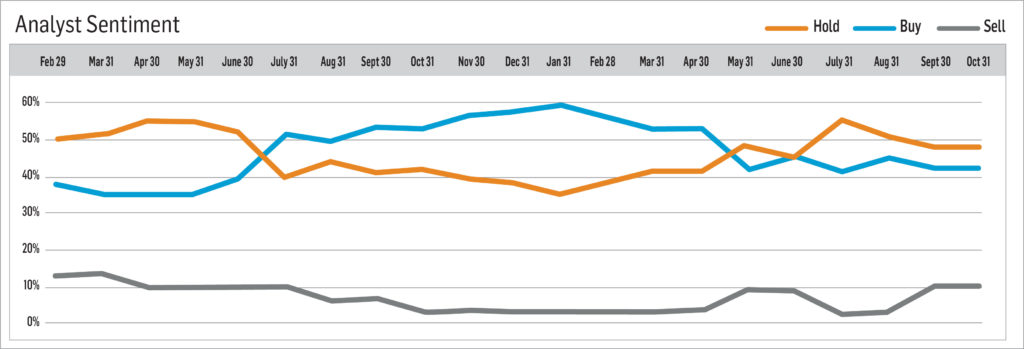

During October, the number of sell-side analysts maintaining “buy” and “hold” ratings on industry stocks was 90%. The percentage of stocks which analysts recommend selling totaled 10%.

“The markets face some important challenges in November,” Johnson said. “The Federal Reserve plans to begin tapering its bond buying program this month. Moreover, supply chain issues continue to impact the economy, and the U.S. Administration is struggling to pass extensive social spending and infrastructure bills.”

Analysis brought to you by:

Direct Selling Capital Advisors provides monthly market analysis abased on research and the TDSI index. The TDSI is a market capitalization weighted index of all domestic public direct selling companies with a market capitalization of at least $25 million.