The Direct Selling Capital Advisors Direct Selling Index (DSCI) declined 17.8 percent in September, marking its third successive monthly decline, following a dip of 8.4 percent in August and 7.4 percent in July. The Dow Jones Industrial Average (DJIA) also sharply declined in September (-4.3 percent).

This decline was experienced by the majority of the DSCI members, with 10 losing more than 10 percent and six losing more than 15 percent of their value during the month. The exceptions were large cap stock Primerica, Inc. (NYSE: PRI) and small cap stock Natural Health Trends Corp. (NASDAQ: NHTC), which both posted gains.

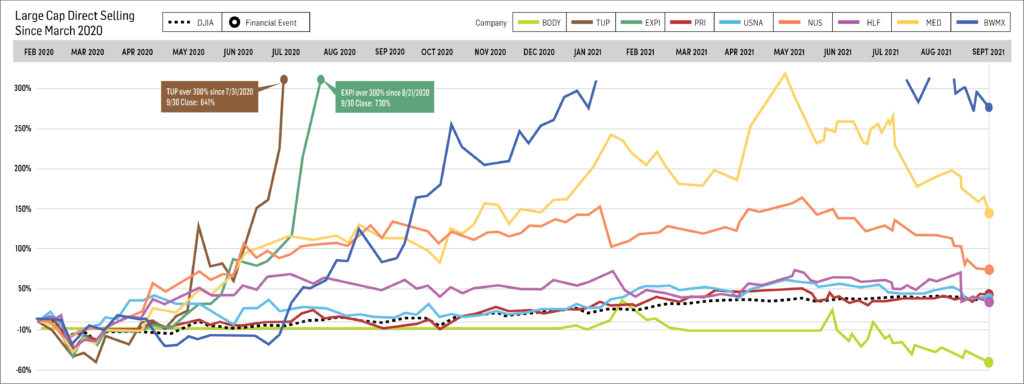

The DSCI has gained a cumulative 58.6 percent since the tracking set began on March 1, 2020, while the DJIA gained a more muted 33.2 percent. At its peak in June 2021, the DSCI had risen 115.6 percent since March 2020. Year-to-date, the DSCI gained 0.3 percent, which is actually impressive given its performance the last three months. By comparison, the DJIA has advanced 12 percent year-to-date.

Investors have had to grapple with a long list of uncertainties, including rising inflation fears, signs of slowing economic growth, ten-year U.S. government bond yields, and almost daily announcements of global supply chain bottlenecks. When some of these issues are resolved, or at least stop worsening, the stock market could improve, which could in turn make for a better environment for direct selling stocks.

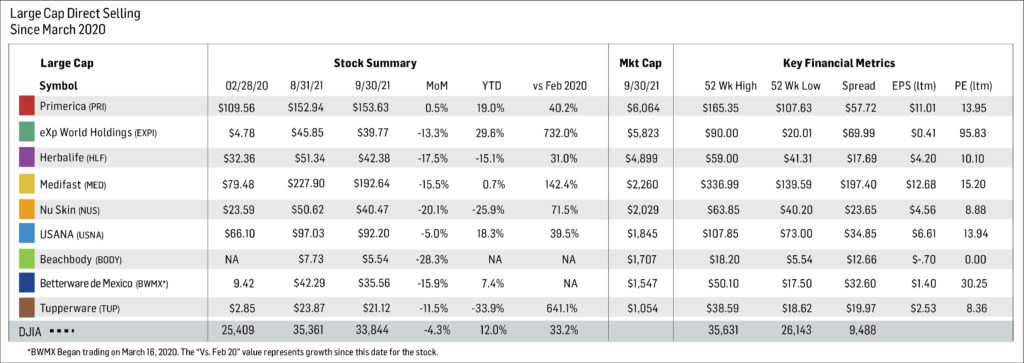

Large Cap Stocks

- Betterware de Mexico (NASDAQ: BWMX) fell 15.9 percent in September despite announcing a $50 million share repurchase program. The company reported strong second quarter earnings in early August, and revenue, EBITDA and net income increased 81 percent, 92 percent and 72 percent, respectively, compared to the prior year. BWMX shares are up 7.4 percent since the start of 2021.

- Tupperware Brands Corporation (NYSE: TUP) declined 11.5 percent in September, bringing its year-to-date losses to 33.9percent. Even so, since March 1, 2020, TUP shares have gained a remarkable 641.1 percent. The company reported second quarter results that easily surpassed Wall Street’s expectations, and quarterly net sales and adjusted EBITDA each increased 17 percent versus the year-ago period.

- Nu Skin Enterprises, Inc. (NYSE: NUS) had the highest dividend yield (3.76 percent) in the DSCI, but its stock declined 20.1percent in August. The company’s shares are down 25.9 percent for the first nine months of 2021, but are still up 71.5 percent since the March 2020 establishment of the DSCI. In early August, NUS reported positive second quarter earnings results and boosted its full-year 2021 EPS guidance to $4.30-$4.50, about a 5 percent increase from the guidance it issued just three months before.

- Herbalife Nutrition, Inc. (NYSE: HLF) declined 17.5 percent in September, primarily because the company cut its third quarter and full-year 2021 earnings projections to $1.00-$1.20 per share and $4.55-$4.95 a share, respectively, from the $1.05-$1.25 and $4.70-$5.10 guidance it issued in early August. The pandemic’s lingering effects resulted in what the company described as “lower than expected levels of activity” among its independent distributors. Year to date, HLF shares have declined 15.1 percent, but appreciated 31 percent since March 2020.

- Medifast, Inc. (NYSE: MED) shares declined 15.5 percent in September after falling 20.2 percent in August. Year-to-date, MED has gained 0.7 percent, and risen 142.4 percent since the March 1, 2020 establishment of the DSCI. The company reported robust second quarter results, with revenues and diluted EPS increasing 79 percent and 113 percent, respectively, compared to the prior year period.

- USANA Health Sciences, Inc. (NYSE: USNA) announced that its third quarter sales are expected to be about 10 percent lower than the same period last year. EPS is now expected to be in the $1.28-$1.33 range, down from $1.44 in the third quarter of 2020, citing COVID-19-related disruptions and lockdowns in several key markets that affected the company’s ability to operate and ship products. USANA did perform better in September than most DSCI components, declining only 5 percent and, year-to-date, the stock has gained 18.3 percent. Since the March 2020 inception of the DSCI, USANA shares have appreciated 39.5 percent, beating the Dow’s 33.2 percent cumulative price increase.

- eXp World Holdings, Inc. (NASDAQ: EXPI) shares declined 13.3 percent in September, cutting its year-to-date gain to 29.6 percent. Since March 1, 2020, EXPI has rallied an astonishing 732 percent. The company’s second quarter results were strong, posting a net sales increase of 183 percent compared with the third quarter of 2020. Equally important, EXPI declared a $0.04 per share quarterly cash dividend to shareholders, its first-ever dividend.

- Primerica, Inc. (NYSE: PRI) is the biggest market cap stock in the DSCI and was a standout performer in September, rising 0.5 percent. The stock is 19 percent higher over the first three quarters of 2021, and 40.2 percent higher since the March 2020 inception of the DSCI. The company’s second quarter earnings included a 25 percent increase in revenue and an earnings per diluted share increase of 28 percent.

- The Beachbody Company, Inc. (NYSE: BODY) stock was the weakest component in the DSCI in September, declining 28.3 percent. Beachbody’s second quarter results showed a 2 percent increase in revenue. Most notably, digital revenue rose 20 percent.

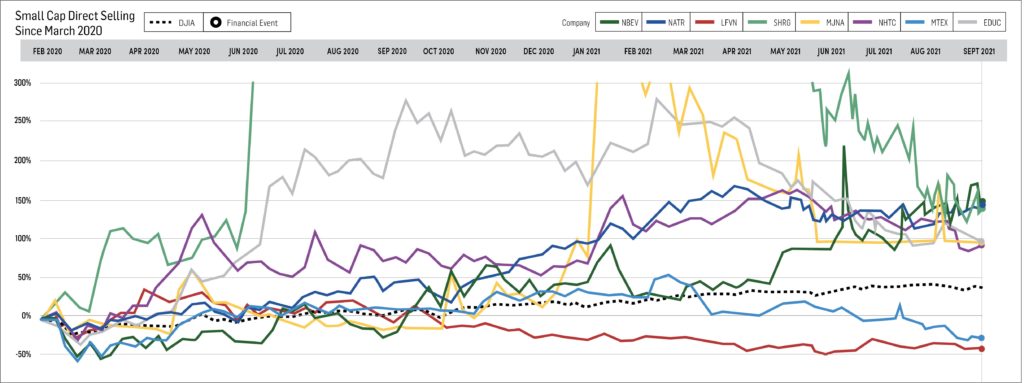

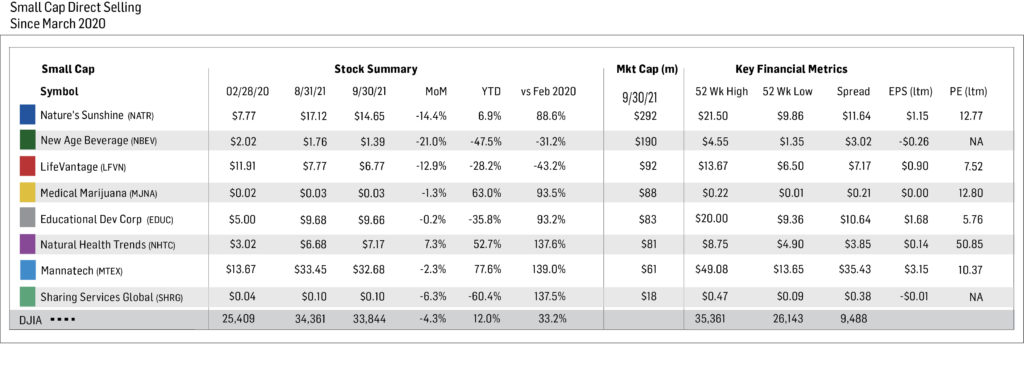

Small Cap Stocks

In spite of a difficult month, the small cap tracking set outperformed its large cap peers.

“Somewhat surprisingly, the small-cap members of the DSCI generally performed better than their large-cap peers in September,” said Stuart Johnson, Direct Selling Capital Advisors CEO. “While seven of the nine large caps declined by double figure percentages in the month, only three of the eight small caps fell by 10% or more. Typically, large cap stocks outperform small caps during times of maximum stress in the market.”

- Natural Health Trends Corp. (NASDAQ: NHTC) was the only small cap to gain in September (+7.3 percent). The stock has appreciated 52.7 percent over the first nine months of 2021 and 137.6 percent since DSCI inception. Natural Health Trends was notified on September 30, 2021 that a non-public investigation by the SEC, which began in August of 2016, was concluded and that the commission did not recommend enforcement action.

Short Interest Data and Analysis

Short interest in industry stocks peaked in mid-August and moved slightly lower through September. Aggregate “days-to-cover” have more than doubled since bottoming in mid-February.

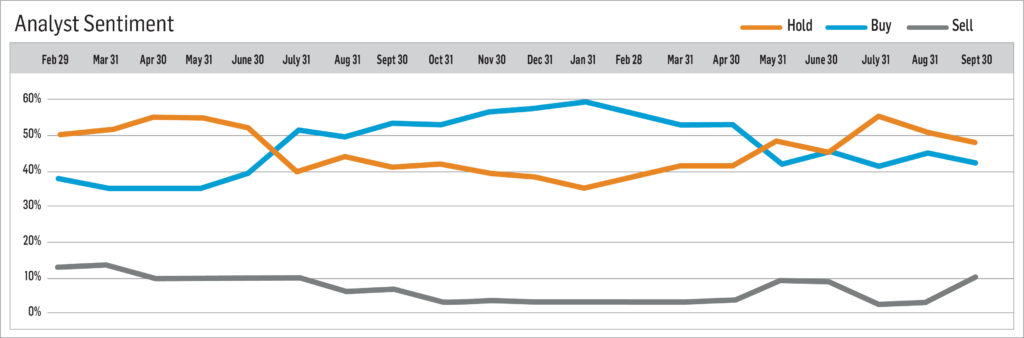

During September, the number of sell-side analysts maintaining “buy” and “hold” ratings on industry stocks declined to around 90 percent from 97 percent in August. The percentage of stocks which analysts recommend selling also rose to 10 percent from just 3 percent in August.

Analysis brought to you by:

Direct Selling Capital Advisors provides monthly market analysis abased on research and the TDSI index. The TDSI is a market capitalization weighted index of all domestic public direct selling companies with a market capitalization of at least $25 million.