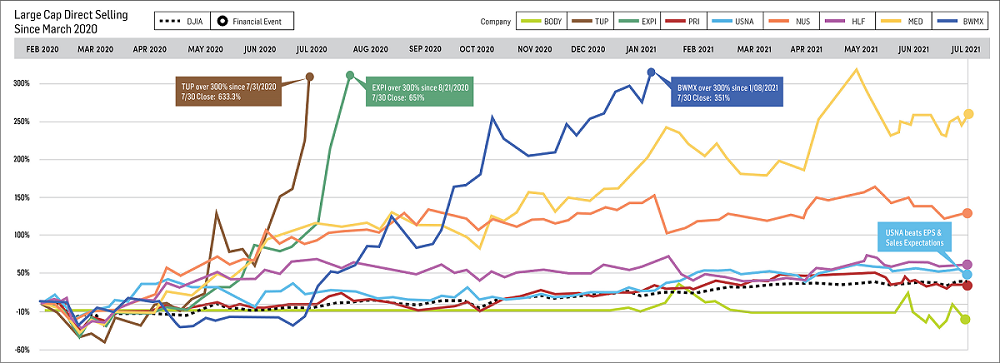

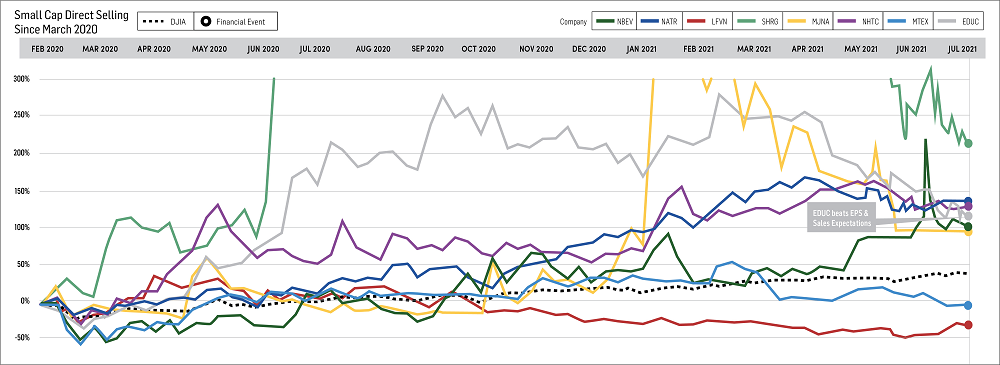

The Direct Selling Capital Advisors Direct Selling Index (DSCI) declined 7.4 percent in July 2021, underperforming the Dow Jones Industrial Average (DJIA), which gained 1.3 percent during the month. Declining performance was spread across the index, with six members—The Beachbody Company, Inc. (NYSE: BODY); Betterware de Mexico, S.A.B. de C.V.’s (NASDAQ: BWMX); Tupperware Brands Corporation (NYSE: TUP); NewAge, Inc. (NASDAQ: NBEV); Educational Development Corporation (NASDAQ: EDUC); and Sharing Services Global Corporation (OTC: SHRG)—each declining more than 10 percent in July. LifeVantage Corporation (NASDAQ: LFVN) was the only direct selling stock within the index to post a double figure percentage gain. In total, 12 of the 17 stocks in the DSCI lost value during the month.

Even taking these losses into consideration, the DSCI has gained a cumulative 99.6 percent since the index began tracking stocks on March 1, 2020. The DJIA gained only 35.9 percent during the same period. Year to date, the DSCI has grown 26.3 percent, outpacing the DJIA’s gain of 14.2 percent.

This recent decline corrects some of the outsized gains that occurred during May, which saw an 18.4 percent increase, and June, which saw an additional 2.2 percent growth.

Many of the tracking set’s Large Cap stocks have posted their second quarter results and reported impressive gains. Of the seven large cap companies, the year-over-year revenue growth reached 42.3 percent. EXPI led the group with 183 percent growth and Medifast was also a standout, with a 79 percent increase.

The third and fourth quarters of 2020 set an exceptionally high bar for year-over-year results within this tracking set. The DSCA forecast still anticipates impressive performance for these companies, but investors are adopting a “sell the news” mentality and maintaining a more cautious approach, which has led to the recent decline.

Given these data points, August appears to be a potentially challenging month for performance in spite of impressive financial results.

“Looking at the remainder of the year, the outlook is somewhat murky,” said Stuart Johnson, Direct Selling Capital Advisors CEO. “The resurgence of COVID-19 has made things difficult to predict. While we believe the industry is now well equipped and prepared to handle any resulting business disruptions based on performance over the last 17 months, we don’t know if the impact on consumer behavior will be similar. Regardless, we continue to expect record domestic direct selling revenue in 2021 and our long-term outlook for the industry remains decidedly bullish.”

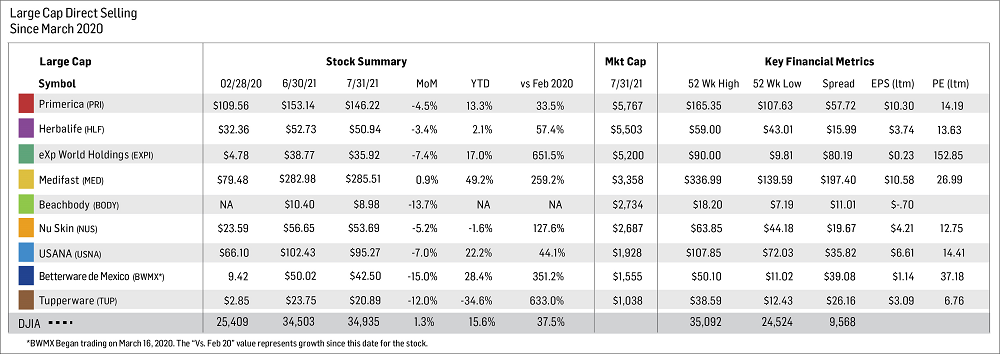

Large Cap Stocks

- Betterware de Mexico (NASDAQ: BWMX) fell 15 percent in July, reversing a 15.2 percent gain in June. Shares continue to be up by 26.4 percent since the beginning of the year and 351.2 percent since it began trading in March 2020 after merging with SPAC DD3 Acquisitions Corp. BWMX serves three million households through distributors and associates in approximately 800 communities in Mexico. The company’s year-over-year revenue grew 82 percent in the second quarter of this year, with an EPS growth of 61 percent.

- Tupperware Brands Corporation (NYSE: TUP) declined 12 percent in July to bring its year-to-date losses to 34.6 percent. Even so, the decline only slightly offsets the company’s approximately 800 percent gain in 2020. In late June 2021, TUP’s Board of Directors authorized a $250 million stock repurchase plan, equivalent to 20-25 percent of shares outstanding, reasoning that the company’s turnaround plan had successfully improved its liquidity position. TUP also announced a $58 million prepayment of its term loan, continuing the transformation of the Company’s balance sheet.

- Nu Skin Enterprises, Inc. (NYSE: NUS) shares declined 5.2 percent in July. Shares are down a total of 1.6 percent for the year, but up 127.6 percent since March 2020. Revenue increased 15 percent year-over-year and EPS grew 42 percent. As a result, NUS boosted its full-year 2021 EPS guidance to $4.30-$4.50, a 5 percent increase from the guidance it issued just three months before.

- Herbalife Nutrition, Inc. (NYSE: HLF) declined 3.4 percent in July, but overall the shares have gained 57.4 percent since March 2020. Net sales in the second quarter reached $1.6 billion, up 15 percent from a year ago. Adjusted EBITDA also rose significantly, reaching $262 million, 18 percent higher than in the same quarter of the previous year.

- Medifast, Inc. (NYSE: MED) stock was the only large cap direct selling stock to increase in July, rising 0.9 percent. Revenues during the second quarter increased 79 percent from the previous year’s period. Diluted EPS also grew, reaching $3.96, a 113 percent spike from the previous year. MED is now boosting its full-year 2021 revenue guidance to $1.425-$1.475 billion. MED shares have increased 49.2 percent since year-end 2020 and 259 percent since March 2020.

- USANA Health Sciences, Inc. (NYSE: USNA) shares fell 7% in July. The company’s year-to-date gains now stand at 22 percent. Second quarter net sales and diluted earnings per share jumped 30.1 percent and 41.7 percent, respectively, from the same period during 2020. The stock declined about 5 percent following the financial report but DSCA analysts expect the stock to reverse higher. Since March 2020, USANA shares have increased about 44 percent, beating the Dow’s 36 percent cumulative price increase.

- eXp World Holdings, Inc. (NASDAQ: EXPI) declined 7.4 percent in July. However, since March 2020, the shares have risen 651.5 percent. The company’s second quarter revenue increased 183 percent year-over-year to a record $1 billion, and its real estate agent roster expanded 83 percent. EXPI also declared a $0.04 per share quarterly cash dividend to shareholders, its first-ever dividend. Even after repurchasing $55 million of stock in the second quarter, the company’s cash balance increased $44 million. With these announcements, the stock saw a 36 percent increase in price on August 4 and the stock has remained in a general upward trend since that time.

- Primerica, Inc. (NYSE: PRI) was the third-best performer among the large cap stocks in the DSCI in July, declining by 4.5 percent. and standing 33 percent higher than its March 2020 levels. The company’s second quarter financial results surpassed analyst expectations with year-over-year revenue of 24.3 percent and EPS growth of 32.4 percent.

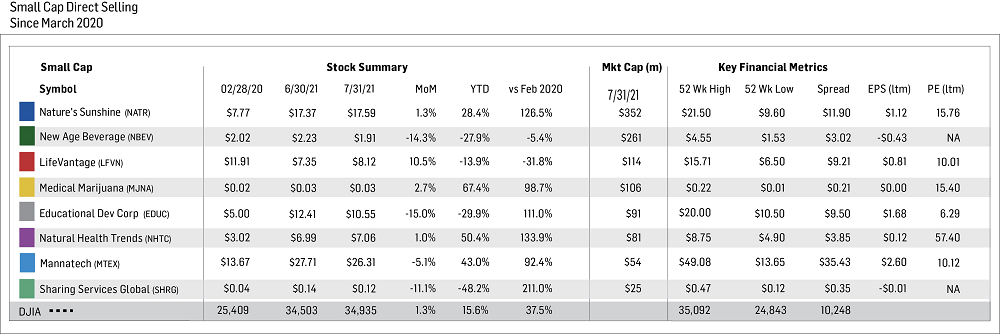

Small Cap Stocks

- LifeVantage Corporation (NASDAQ: LFVN) was by far the best performing small cap in July, with a 10.5 percent growth rate. The stock is now down an aggregate 13.9 percent over the first seven months of 2021.

- Educational Development Corporation (NASDAQ: EDUC) fell 15 percent during July in spite of solid second quarter earnings. This decline brought the stock’s year-to-date loss to 29.9 percent. Net revenues increased $2.5 million, or 6.5 percent, in the quarter, and nearly all of these incremental revenues fell to the bottom line, as pretax earnings rose $1.9 million, or just over 80 percent.

- NewAge, Inc. (NASDAQ: NBEV) has a year-to-date decline of nearly 28 percent and has continued a downward trend with a loss of 14.3 percent in July. The company’s second quarter results included record revenue, however, of $124 million and improved operating results. Since the release of these earnings, NBEV traded generally higher, before pulling back some over the last several sessions.

Short Data & Analysis

Short interest in industry stocks continued to increase through mid-July. Days to cover have increased 150 percent after bottoming in February and now stands at its highest level since May of 2020. A larger number of investors have begun betting against direct selling stocks, but any more movement toward an increase in short interest could result in a bullish short squeeze.

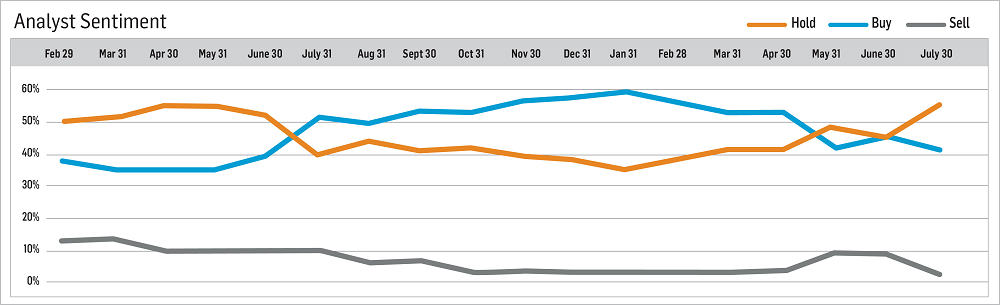

The number of sell-side analysts maintaining buy and hold ratings on industry stocks jumped to around 97 percent, from a dip to 90 percent in June. The number of hold recommendations increased as related to the number of buy recommendations. The percentage of stocks that analysts recommend selling fell to 3 percent, versus about 10 percent in June.

Analysis brought to you by:

Direct Selling Capital Advisors provides monthly market analysis abased on research and the TDSI index. The TDSI is a market capitalization weighted index of all domestic public direct selling companies with a market capitalization of at least $25 million.