Direct Selling Capital Advisors’ Stock Watch June 2021

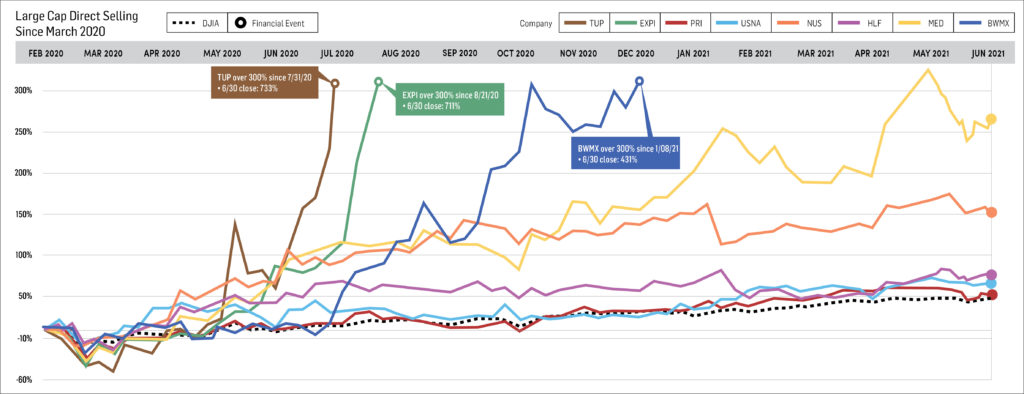

May brought an incredible rush of growth for direct selling stocks (+18.4 percent), and the Direct Selling Capital Advisors Direct Selling Index (DSCI) added 2.2 percent more in June. This increase is slightly above the Dow Jones Industrial Average (DJIA), which grew by 1.9 percent.

eXp World Holdings, Inc. (NASDAQ: EXPI) carried much of this positive momentum, with a 20.2 percent gain. Twelve of the 16 individual stocks in the index did decline, which was expected given May’s blistering performance. The DSCI continues to set record highs, up 115.6 percent since the tracking period began on March 1, 2020. The DJIA gained 35.9 percent during this same time period, showing the DSCI to significantly outperform the broader market. On a year-to-date basis, DSCI gained 36.4 percent, compared to 14.2 percent for the DJIA.

After moderate profit-taking by most direct selling stocks last month, muted stock price movements are now expected for July. Second quarter earnings reports will be the next key event to consider, and most will likely be released in early August.

“First-quarter year-over-year earnings comparisons for direct selling stocks were fairly easy, as first quarter 2021 reflected a boost from pandemic trends while those factors played no role in the first quarter of 2020 results,” said Stuart Johnson, Direct Selling Capital Advisors CEO. “However, those trends were largely reflected in consumer behavior by the second quarter of 2020. Consequently, second quarter of 2021 earnings comparisons should prove more challenging than in Q1 2021, but we still expect the companies comprising our large cap tracking set, as a whole, to report strong second quarter revenue and earnings results.”

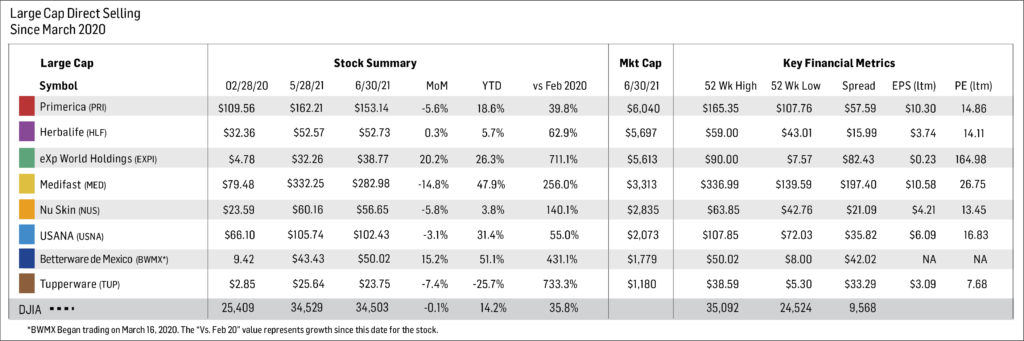

Large Cap Stocks

Three of the eight members of the large cap direct selling stocks tracking set advanced in June, while the others declined, reflecting the uneven nature of the index. All eight companies, however, have outpaced the DJIA since March 2020.

A notable event within this group was the merger of the Beachbody Company Group, LLC with Forest Road Acquisition Corp. (NYSE: FRX), a special purpose acquisition company (SPAC) that also includes Myx Fitness Holdings, LLC. This new combined company will operate under the name The Beach Body Company, Inc. and will trade on the NYSE under the symbol BODY. The company’s stock closed at $12 per share on June 25 with an implied market capitalization of around $3.65 billion. Beachbody’s first quarter financial summary also included summary results for Myx, and on a consolidated basis, the company reported revenue of $243.3 million for the quarter—a 43 percent increase year-over-year. Total 2021 revenue for BODY is expected to exceed $1 billion. Beginning next month, BODY will join the DSCI large cap tracking set.

- Betterware de Mexico (NASDAQ: BWMX) gained 15.2 percent in June and stands 51.1 percent higher since the beginning of the year, and 431 percent higher than when it began trading in March 2020. The company’s sharp rally in June was likely a reflection of long-term investors factoring in strong first quarter earnings results. Betterware de Mexico serves 3 million households in approximately 800 communities in Mexico.

- Tupperware Brands Corporation (NYSE: TUP) continued its decline (-7.4 percent) during the month after astounding 2020 gains of approximately 800 percent. Year-to-date, TUP’s losses average 25 percent. Shares rebounded slightly, ending June about 17 percent higher than its June 21 lows after the Board of Directors authorized a $250 million stock repurchase plan and a $58 million prepayment of its term loan.

- Nu Skin Enterprises, Inc. (NYSE: NUS) fell 5.8 percent after a 14.5 percent gain in May. Its May strengthening was likely due to a strong first quarter earnings report, which included a 31 percent year-over-year revenue increase. Since March 2020, NUS has still dramatically outpaced the Dow, gaining 140.1 percent, compared with a 35.9 percent gain for the broader market.

- Herbalife Nutrition, Inc. (NYSE: HLF) gained 0.3 percent in June and held onto its May gains of approximately 15 percent. HLF shares are up 62.9 percent since March 2020.

- Medifast, Inc. (NYSE: MED) shares declined 14.8 percent in June, surrendering almost a third of its 46 percent gain in May. MED’s shares reacted positively to first quarter earnings, which reported revenue increases of 91 percent year-over-year. The company is projecting a 54 percent increase for 2021 revenue. Shares have increased 256 percent since March 2020.

- USANA Health Sciences, Inc. (NYSE: USNA) fell 3.1 percent in June following a 17.5 percent gain in May. Through mid-year 2021, USNA has more than doubled the performance of the DJIA in 2021, rising 31.4 percent versus 14.2 percent for the stock market index.

- eXp World Holdings (NASDAQ: EXPI) led the large cap tracking set, rising 20.2 percent in June. Since March 2020, EXPI shares have risen more than 700 percent. In its first quarter earnings report, the company’s revenue increased 115 percent year-over-year, with agent numbers expanding 77 percent.

- Primerica, Inc. (NYSE: PRI) declined 5.6 percent in June, but hit 52-week highs of around $165 in early June before correcting at the end of the month. PRI is trading well above its late October 52-week low of about $107.

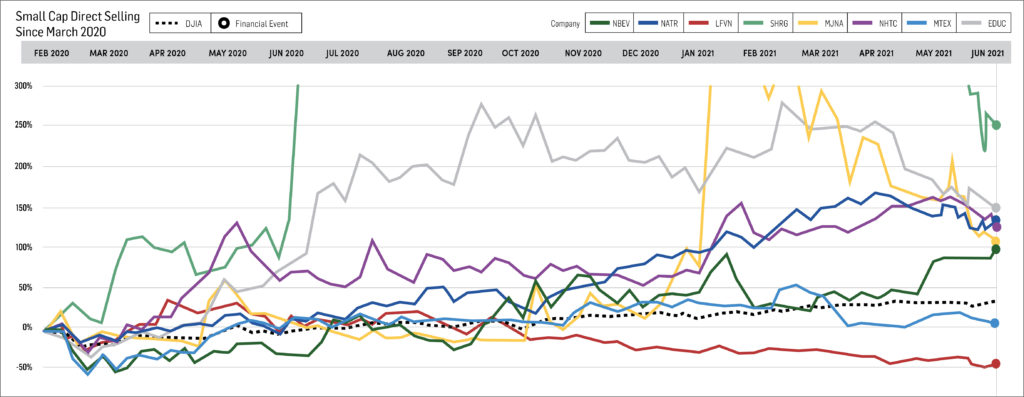

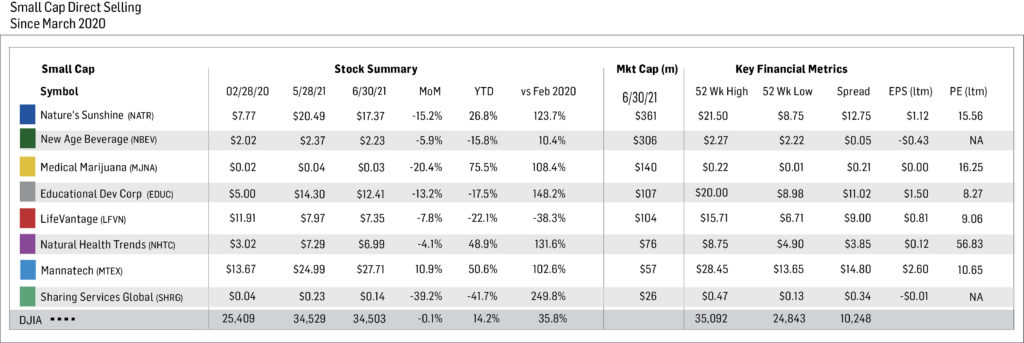

Small Cap Stocks

With the exception of Mannatech Incorporated (NASDAQ: MTEX), which rose 10.9 percent in the month, seven of the eight small cap stocks in the DSCA tracking group declined.

Mannatech announced a tender offer to purchase just over 10 percent of its total outstanding shares at a price of $26, representing a premium of nearly 28 percent to the stock’s closing price in the previous session. On June 30, the company announced that only 8.31 percent of the total shares outstanding were tendered, illustrating that the majority of shareholders believed $26 was too low a price to surrender their shares. This move is an encouraging sign for MTEX, given that non-insiders hold about half of the company’s shares.

Short Interest and Data Analysis

Short interest in industry stocks moved noticeably higher from mid-May to mid-June, which is not unexpected given the elevated trading levels of so many of the DSCA stock tracking groups. HLF, USNA, NUS and TUP experienced the largest increases in “days to cover” during this period.

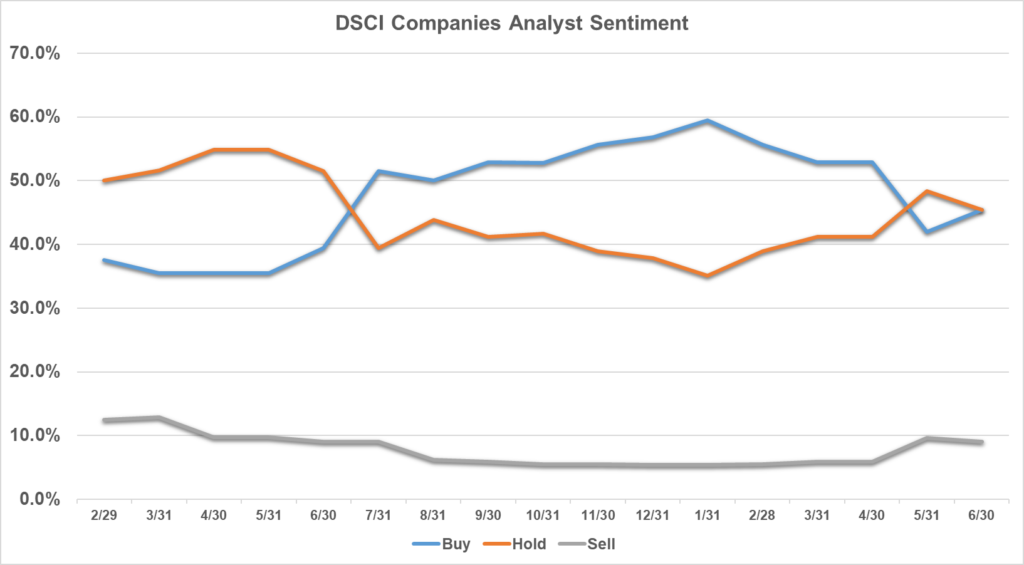

Analysts maintaining “buy” and “hold” ratings on industry stocks remained flat at approximately 90 percent, while those maintaining “sell” ratings held at just under 10 percent.

Analysis brought to you by:

Direct Selling Capital Advisors (formerly Transformation Capital) provides monthly market analysis abased on research and the TDSI index. The TDSI is a market capitalization weighted index of all domestic public direct selling companies with a market capitalization of at least $25 million.