Direct Selling Capital Advisors’ Stock Watch April 2021

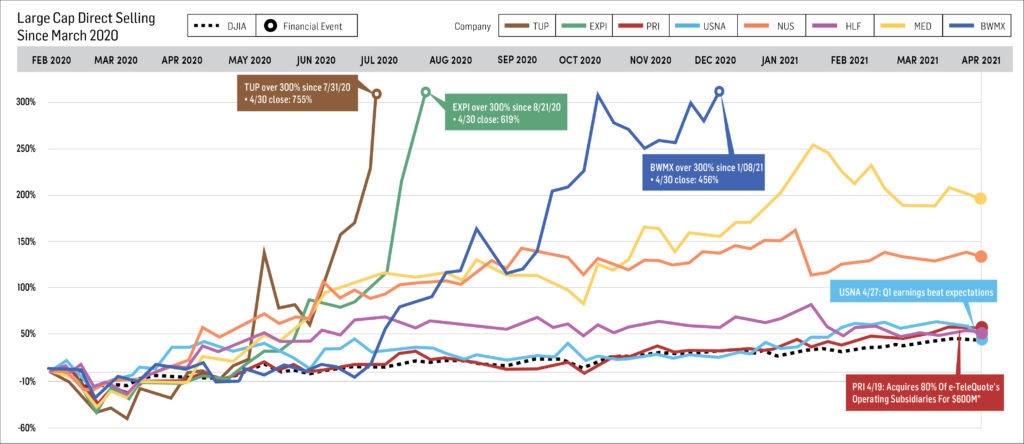

March was a tumultuous month for direct selling stocks, but April proved to move the group marginally higher, with the Direct Selling Capital Advisors Direct Selling Index (DSCI) rising 3.1 percent during the month, compared to a slightly lower gain for the Dow Jones Industrial Average (DJIA) of 2.7 percent. This rise in April places the DSCI in line with the broader markets.

Since the tracking period began March 1, 2020, the DSCI remains up 79.1 percent, compared to a DJIA gain of 33.3 percent. Considering a year-to-date basis, the DSCI retains a slight lead over the DJIA, with gains of 11.4 percent, compared to 10.4 percent.

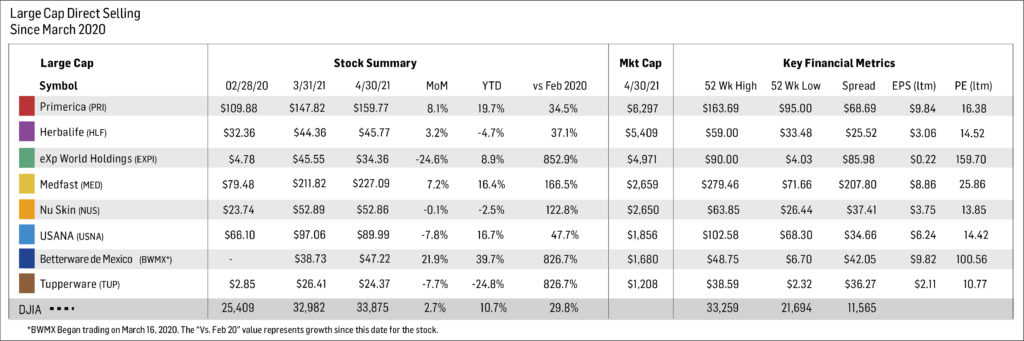

Large Cap Stocks

Most of the large cap stocks within the DSCI tracking set reported strong revenue, exceeding even optimistic estimates, with the average year-over-year revenue growth in this group reaching 63.3 percent. The company trailing the group with the least growth still grew more than 15 percent. Collectively, the companies’ revenue grew by $2.76 billion in the first quarter.

Much of this growth is being driven by the domestic market. Medifast, Inc. (NYSE: MED), a primarily domestic company, grew revenue 91 percent year-over-year, and the North American segment of Nu Skin Enterprises, Inc. (NYSE: NUS) grew 97 percent year-over-year.

First quarter data for this grouping showed that 80 percent of the 50 companies within the tracking set reported year-over-year revenue growth for the first quarter of 2021.

- Betterware de Mexico (NASDAQ: BWMX) went public last year in a merger with a special purpose acquisition company (SPAC) and has since been a new standout to the large cap tracking set. The Mexican direct seller has a current market capitalization of approximately $1.7 billion and rose nearly 22 percent over the course of the month, climbing nearly 40 percent year-to-date. As of the end of April, the stock had increased more than 450 percent since the merger was finalized with the SPAC in March 2020.

- Tupperware Brands Corporation (NYSE: TUP) fell 7.7 percent in April, but remains one of the top leaders within the tracking set, with gains of 755.1 percent since February 28 of last year. The company’s turnaround plan has made significant progress in the last year, including a return to significant growth and a tidier balance sheet. First quarter financial results for the company included 22 percent revenue growth and a net income of $45.3 million.

- Nu Skin Enterprises, Inc. (NYSE: NUS) was mostly flat in April but remains approximately 123 percent above its levels in February of last year. The stock traded in a sideways consolidating pattern for most of the month. The company’s Q1 results included 31 percent revenue growth and has since traded aggressively higher.

- Herbalife Nutrition, Inc. (NYSE: HLF) has followed the trading pattern of NUS almost exactly—trading down significantly for several months and now moving aggressively higher following impressive first quarter reports. HLF increased 3.2 percent in April and stands 41.4 percent above its levels in February of 2020. Its first quarter report included 19 percent year-over-year revenue growth and strong performance within its North American market which increased sales by 30 percent year-over-year.

- Medifast, Inc. (NYSE: MED) gained 7.2 percent in April and now stands 185.7 percent above its February 28, 2020 levels. The stock spent most of the month trading in a calm but upward pattern, then surged higher following reports of a 91 percent year-over-year revenue growth in the first quarter.

- USANA Health Sciences, Inc. (NYSE: USNA) has been a strong performer over the last several months, reaching several 52-week highs in early 2021. While it spent much of April in a tight consolidating pattern with an upward bias, the company reported 15.5 percent revenue growth year-over-year in the first quarter, and surprisingly traded aggressively lower. It has since recouped much of those losses and has climbed back above its 50-day moving average.

- eXp World Holdings (NASDAQ: EXPI) declined 24.6 percent during April. The company has had a remarkable growth story this year and remains up 8.9 percent year-to-date and 618.8 percent since March 2020. In spite of reporting record revenue and growth numbers for the first quarter, it fell short of analyst expectations and declined as a result. Year-over-year revenue growth for the company stands at 115 percent.

- Primerica, Inc. (NYSE: PRI) increased 8.1 percent in April and now stands 45.4 percent higher since March 2020 and 19.7 percent higher year-to-date. The company reported 21 percent revenue growth year-over-year and has since trended steadily upward.

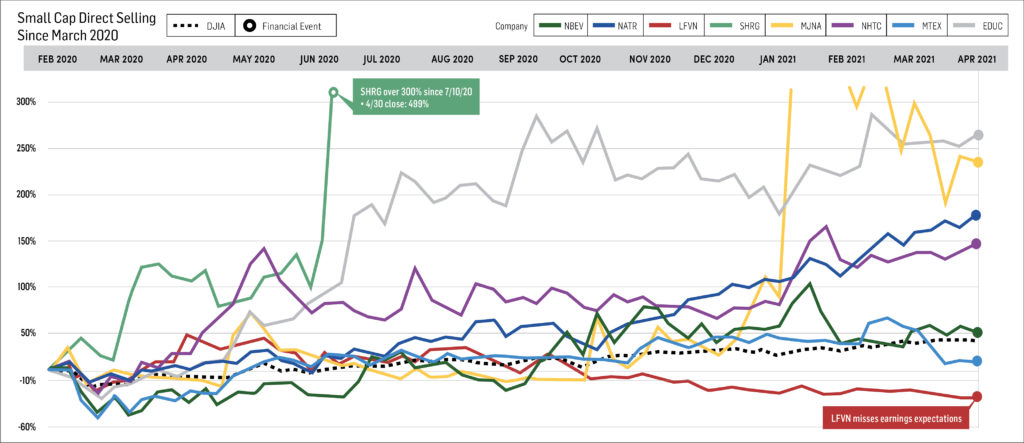

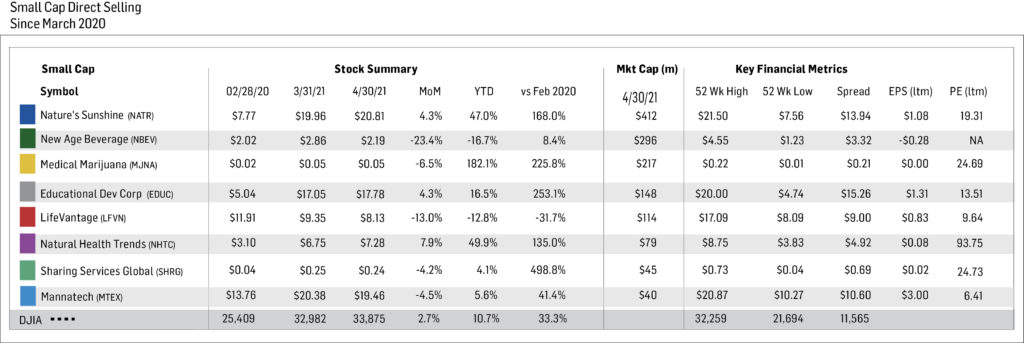

Small Cap Stocks

Nature’s Sunshine Products, Inc. (NASDAQ: NATR) is the largest group within the tracking set with a market capitalization of $412 million. It continued its general upward trend and continually sets new 52-week highs on a regular basis. The stock moved 4.3 percent higher and now stands 168 percent above its March 2020 levels and 47 percent higher on a year-to-date basis. The company reported $102.6 million in first quarter revenue and has since trended in a sideways pattern.

Short Interest Data & Analysis

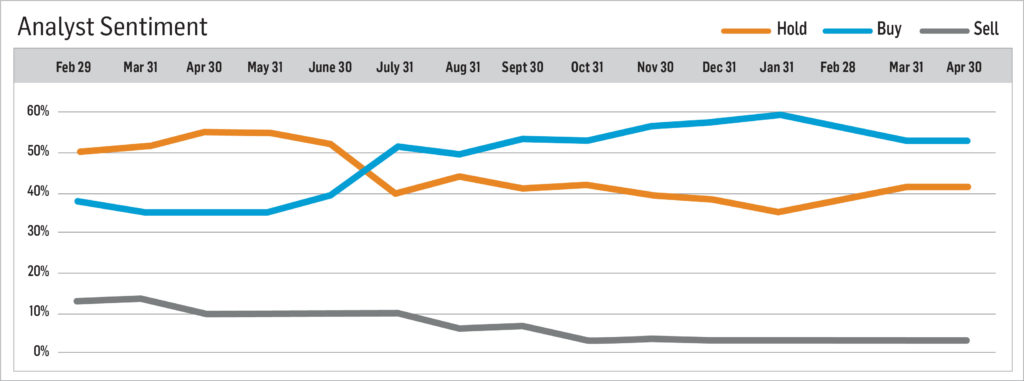

Short interest in industry stocks trended generally lower over the course of April but remain in the same range of 3.5 days to cover. The number of sell-side analysts maintaining “buy” and “hold” ratings on industry stocks remained flat at approximately 97 percent, but the number of analysts recommending “hold” as opposed to “buy” increased slightly. Analysts maintaining “sell” was miniscule.

“To say that direct selling companies reported strong first quarter financial results would be a clear understatement,” said Stuart Johnson, Direct Selling Capital Advisors CEO. “While we had been expecting an impressive performance, they, for the most part, hit it out of the proverbial park with average revenue growth of 63.3 percent amongst our large cap tracking set. While we continue to believe that the rate of year-over-year growth will likely begin to slow in the second quarter of the year, we are now more than comfortable in projecting that 2021 will result in another record year for domestic direct selling revenue.